MarketBeat

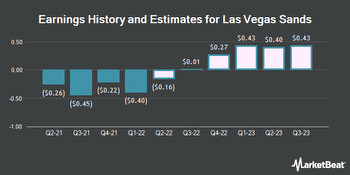

Reports say 2022 was good for Nevada casinos, Vegas tourism

LAS VEGAS (AP) - The year 2022 was good for gambling and tourism in Nevada, where winnings at casinos statewide set calendar year records and Las Vegas visitor tallies nearly reached levels before the coronavirus pandemic.

"Las Vegas enjoyed a robust recovery trajectory across core tourism indicators in 2022," the regional Convention and Visitors…