Las Vegas Sands Corp. (NYSE:LVS) Short Interest Update

Las Vegas Sands Corp. (NYSE:LVS - Get Rating) was the recipient of a significant increase in short interest during the month of December. As of December 15th, there was short interest totalling 18,270,000 shares, an increase of 7.5% from the November 30th total of 17,000,000 shares. Approximately 5.6% of the company's stock are sold short. Based on an average daily volume of 6,970,000 shares, the short-interest ratio is currently 2.6 days.

Las Vegas Sands Stock Performance

LVS stock traded up $0.85 during trading on Tuesday, reaching $48.92. 292,074 shares of the stock were exchanged, compared to its average volume of 4,583,257. Las Vegas Sands has a twelve month low of $28.88 and a twelve month high of $49.73. The company has a market capitalization of $37.38 billion, a P/E ratio of 19.62 and a beta of 1.12. The stock has a 50 day simple moving average of $44.01 and a 200-day simple moving average of $39.39. The company has a current ratio of 1.83, a quick ratio of 1.82 and a debt-to-equity ratio of 3.64.

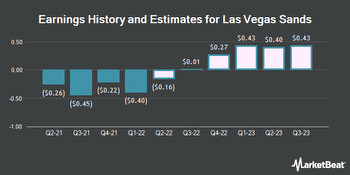

Las Vegas Sands (NYSE:LVS - Get Rating) last released its earnings results on Wednesday, October 19th. The casino operator reported ($0.27) earnings per share for the quarter, missing analysts' consensus estimates of ($0.20) by ($0.07). Las Vegas Sands had a negative return on equity of 25.33% and a net margin of 46.94%. The firm had revenue of $1.01 billion for the quarter, compared to analyst estimates of $1.01 billion. During the same period last year, the business earned ($0.45) earnings per share. The firm's quarterly revenue was up 17.3% compared to the same quarter last year. As a group, sell-side analysts anticipate that Las Vegas Sands will post -1.19 earnings per share for the current year.

Institutional Investors Weigh In On Las Vegas Sands

A number of institutional investors have recently added to or reduced their stakes in LVS. Raymond James Financial Services Advisors Inc. boosted its holdings in Las Vegas Sands by 13.9% during the first quarter. Raymond James Financial Services Advisors Inc. now owns 46,767 shares of the casino operator's stock valued at $1,818,000 after purchasing an additional 5,716 shares in the last quarter. American Century Companies Inc. boosted its holdings in Las Vegas Sands by 17.1% during the first quarter. American Century Companies Inc. now owns 13,612 shares of the casino operator's stock valued at $529,000 after purchasing an additional 1,985 shares in the last quarter. Cambridge Investment Research Advisors Inc. boosted its holdings in Las Vegas Sands by 6.9% during the first quarter. Cambridge Investment Research Advisors Inc. now owns 33,282 shares of the casino operator's stock valued at $1,294,000 after purchasing an additional 2,145 shares in the last quarter. Cetera Advisor Networks LLC boosted its holdings in Las Vegas Sands by 26.7% during the first quarter. Cetera Advisor Networks LLC now owns 13,502 shares of the casino operator's stock valued at $525,000 after purchasing an additional 2,848 shares in the last quarter. Finally, PNC Financial Services Group Inc. boosted its holdings in Las Vegas Sands by 47.6% during the first quarter. PNC Financial Services Group Inc. now owns 27,000 shares of the casino operator's stock valued at $1,050,000 after purchasing an additional 8,711 shares in the last quarter. 39.75% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several equities analysts have weighed in on LVS shares. Morgan Stanley started coverage on Las Vegas Sands in a report on Monday, November 21st. They set an "overweight" rating and a $49.00 target price on the stock. JPMorgan Chase & Co. raised their target price on Las Vegas Sands from $44.00 to $51.00 and gave the company an "overweight" rating in a report on Monday, November 28th. StockNews.com started coverage on Las Vegas Sands in a report on Wednesday, October 12th. They set a "sell" rating on the stock. Jefferies Financial Group upgraded Las Vegas Sands from a "hold" rating to a "buy" rating in a report on Monday, September 26th. Finally, Stifel Nicolaus raised their target price on Las Vegas Sands from $50.00 to $55.00 in a report on Wednesday, December 7th. One research analyst has rated the stock with a sell rating, two have assigned a hold rating, ten have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $51.17.

About Las Vegas Sands

(Get Rating)Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Las Vegas Sands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Las Vegas Sands wasn't on the list.

While Las Vegas Sands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat's analysts have just released their top five short plays for January 2023. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.