Rush Street Interactive (NYSE:RSI) Now Covered by Analysts at JMP Securities

JMP Securities began coverage on shares of Rush Street Interactive (NYSE:RSI – Get Rating) in a report released on Tuesday, MarketBeat reports. The firm issued an outperform rating and a $12.00 target price on the stock.

Other analysts have also issued research reports about the company. Oppenheimer cut their target price on Rush Street Interactive from $14.00 to $11.00 in a research report on Thursday, March 3rd. Benchmark cut their target price on Rush Street Interactive from $27.00 to $16.00 and set a buy rating on the stock in a research report on Thursday, March 10th. Needham & Company LLC cut their target price on Rush Street Interactive from $17.00 to $12.00 and set a buy rating on the stock in a research report on Thursday, March 3rd. Wells Fargo & Company raised Rush Street Interactive from an equal weight rating to an overweight rating and set a $10.00 target price on the stock in a research report on Wednesday, April 27th. Finally, Craig Hallum lowered Rush Street Interactive from a buy rating to a hold rating and set a $10.00 price objective on the stock. in a research report on Thursday, March 3rd. Two analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of Moderate Buy and an average price target of $15.33.

RSI opened at $4.98 on Tuesday. Rush Street Interactive has a one year low of $4.06 and a one year high of $21.83. The stock has a market capitalization of $1.09 billion, a PE ratio of -8.89 and a beta of 1.80. The business’s 50 day moving average price is $5.69 and its 200 day moving average price is $8.94.

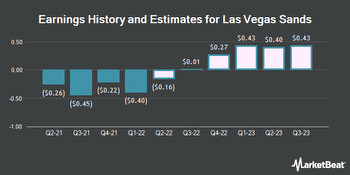

Rush Street Interactive (NYSE:RSI – Get Rating) last released its quarterly earnings data on Wednesday, May 4th. The company reported ($0.24) EPS for the quarter, missing analysts’ consensus estimates of ($0.21) by ($0.03). The business had revenue of $134.94 million during the quarter, compared to analyst estimates of $135.40 million. Rush Street Interactive had a negative net margin of 6.68% and a negative return on equity of 16.88%. The company’s revenue was up 20.7% on a year-over-year basis. During the same quarter in the prior year, the company posted ($0.08) earnings per share. As a group, equities analysts predict that Rush Street Interactive will post -0.45 earnings per share for the current year.In other Rush Street Interactive news, major shareholder Gregory A. Carlin sold 80,894 shares of the company’s stock in a transaction on Thursday, May 26th. The shares were sold at an average price of $6.07, for a total value of $491,026.58. Following the completion of the transaction, the insider now owns 3,169,106 shares in the company, valued at $19,236,473.42. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders sold 87,713 shares of company stock valued at $540,192 in the last 90 days. 76.06% of the stock is currently owned by insiders.

Institutional investors and hedge funds have recently made changes to their positions in the company. Two Sigma Advisers LP boosted its stake in shares of Rush Street Interactive by 144.1% during the third quarter. Two Sigma Advisers LP now owns 94,700 shares of the company’s stock worth $1,819,000 after buying an additional 55,900 shares during the period. Dynamic Advisor Solutions LLC acquired a new stake in shares of Rush Street Interactive during the fourth quarter worth about $329,000. Allspring Global Investments Holdings LLC acquired a new stake in shares of Rush Street Interactive during the fourth quarter worth about $355,000. Strs Ohio boosted its stake in shares of Rush Street Interactive by 16.5% during the fourth quarter. Strs Ohio now owns 14,100 shares of the company’s stock worth $232,000 after buying an additional 2,000 shares during the period. Finally, Advisor Group Holdings Inc. boosted its stake in shares of Rush Street Interactive by 192.0% during the fourth quarter. Advisor Group Holdings Inc. now owns 61,563 shares of the company’s stock worth $1,016,000 after buying an additional 40,483 shares during the period. Institutional investors and hedge funds own 36.45% of the company’s stock.

Rush Street Interactive Company Profile (Get Rating)

Rush Street Interactive, Inc operates as an online casino and sports betting company in the United States and Latin America. It provides real-money online casino, online and retail sports betting, and social gaming services. In addition, the company offers full suite of games comprising of bricks-and-mortar casinos, table games, and slot machines.