Short Interest in Las Vegas Sands Corp. (NYSE:LVS) Decreases By 20.9%

Las Vegas Sands Corp. (NYSE:LVS - Get Rating) saw a large decrease in short interest in the month of July. As of July 31st, there was short interest totalling 17,560,000 shares, a decrease of 20.9% from the July 15th total of 22,190,000 shares. Based on an average daily volume of 7,110,000 shares, the short-interest ratio is currently 2.5 days. Approximately 5.3% of the company's stock are short sold.

Institutional Investors Weigh In On Las Vegas Sands

A number of large investors have recently bought and sold shares of the business. Vanguard Personalized Indexing Management LLC increased its position in Las Vegas Sands by 133.7% in the 2nd quarter. Vanguard Personalized Indexing Management LLC now owns 27,220 shares of the casino operator's stock valued at $914,000 after acquiring an additional 15,575 shares in the last quarter. American International Group Inc. increased its holdings in shares of Las Vegas Sands by 1.5% in the second quarter. American International Group Inc. now owns 96,333 shares of the casino operator's stock valued at $3,236,000 after purchasing an additional 1,387 shares in the last quarter. Northern Trust Corp raised its position in Las Vegas Sands by 0.3% in the 2nd quarter. Northern Trust Corp now owns 3,087,088 shares of the casino operator's stock worth $103,695,000 after purchasing an additional 8,441 shares during the last quarter. Sculptor Capital LP acquired a new position in Las Vegas Sands during the 2nd quarter worth $41,358,000. Finally, LPL Financial LLC lifted its holdings in Las Vegas Sands by 39.8% during the 2nd quarter. LPL Financial LLC now owns 207,610 shares of the casino operator's stock worth $6,974,000 after buying an additional 59,074 shares in the last quarter. 34.33% of the stock is currently owned by institutional investors.

Las Vegas Sands Stock Performance

Ad TradewinsThe Safest Option in Trades!If you’re new to trading, then you’ve probably heard the wrong thing about options—that they’re risky, unpredictable, or difficult.And it couldn’t be more wrong! With the Hughes Optioneering Strategy, you’ll soon learn that the safest option for new accounts is options themselves!Las Vegas Sands stock opened at $38.67 on Friday. Las Vegas Sands has a 52-week low of $28.88 and a 52-week high of $48.27. The company has a debt-to-equity ratio of 3.63, a current ratio of 3.35 and a quick ratio of 3.33. The stock has a fifty day moving average price of $35.31 and a two-hundred day moving average price of $37.44. The firm has a market capitalization of $29.55 billion, a P/E ratio of 16.96 and a beta of 1.25.

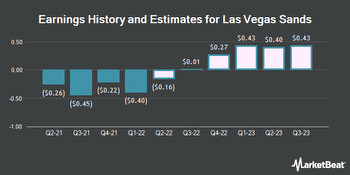

Las Vegas Sands (NYSE:LVS - Get Rating) last announced its earnings results on Wednesday, July 20th. The casino operator reported ($0.34) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.29) by ($0.05). The firm had revenue of $1.05 billion for the quarter, compared to analyst estimates of $949.40 million. Las Vegas Sands had a negative return on equity of 31.93% and a net margin of 45.39%. The company's revenue for the quarter was down 10.9% compared to the same quarter last year. During the same quarter last year, the business earned ($0.26) EPS. As a group, analysts anticipate that Las Vegas Sands will post -1.1 EPS for the current fiscal year.

Analysts Set New Price Targets

LVS has been the topic of several research reports. UBS Group set a $42.00 price objective on shares of Las Vegas Sands in a research note on Monday, June 20th. Barclays raised their price target on shares of Las Vegas Sands from $39.00 to $43.00 and gave the company an "overweight" rating in a report on Thursday, July 21st. Stifel Nicolaus upped their price target on Las Vegas Sands from $46.00 to $50.00 in a report on Thursday, July 21st. Wells Fargo & Company upgraded shares of Las Vegas Sands from an "equal weight" rating to an "overweight" rating and upped their target price for the company from $43.00 to $45.00 in a research note on Thursday, July 21st. Finally, JPMorgan Chase & Co. raised their price target on shares of Las Vegas Sands from $42.00 to $44.00 in a research report on Thursday, July 21st. Two analysts have rated the stock with a sell rating, three have assigned a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, Las Vegas Sands presently has a consensus rating of "Moderate Buy" and a consensus price target of $48.38.

Las Vegas Sands Company Profile

(Get Rating)Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Las Vegas Sands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Las Vegas Sands wasn't on the list.

While Las Vegas Sands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.