State of New Jersey Common Pension Fund D Decreases Stock Holdings in Las Vegas Sands Corp. (NYSE:LVS)

State of New Jersey Common Pension Fund D cut its position in Las Vegas Sands Corp. (NYSE:LVS - Get Rating) by 2.5% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 205,785 shares of the casino operator's stock after selling 5,204 shares during the quarter. State of New Jersey Common Pension Fund D's holdings in Las Vegas Sands were worth $7,721,000 as of its most recent filing with the Securities and Exchange Commission.

Several other institutional investors and hedge funds have also made changes to their positions in LVS. Sculptor Capital LP purchased a new position in shares of Las Vegas Sands in the second quarter valued at $41,358,000. Prudential Financial Inc. boosted its stake in shares of Las Vegas Sands by 233.1% in the first quarter. Prudential Financial Inc. now owns 984,120 shares of the casino operator's stock valued at $38,253,000 after purchasing an additional 688,676 shares during the period. Bridgewater Associates LP purchased a new position in shares of Las Vegas Sands in the first quarter valued at $21,388,000. Vanguard Group Inc. boosted its stake in shares of Las Vegas Sands by 1.5% in the first quarter. Vanguard Group Inc. now owns 35,537,902 shares of the casino operator's stock valued at $1,381,358,000 after purchasing an additional 519,620 shares during the period. Finally, Price T Rowe Associates Inc. MD boosted its stake in shares of Las Vegas Sands by 1.5% in the second quarter. Price T Rowe Associates Inc. MD now owns 29,793,305 shares of the casino operator's stock valued at $1,000,757,000 after purchasing an additional 440,770 shares during the period. 39.75% of the stock is currently owned by hedge funds and other institutional investors.

Las Vegas Sands Stock Up 0.5 %

NYSE:LVS opened at $53.50 on Friday. The stock has a market capitalization of $40.88 billion, a price-to-earnings ratio of 21.84 and a beta of 1.13. Las Vegas Sands Corp. has a 1-year low of $28.88 and a 1-year high of $54.08. The company's fifty day moving average is $46.46 and its two-hundred day moving average is $40.41. The company has a debt-to-equity ratio of 3.64, a quick ratio of 1.82 and a current ratio of 1.83.

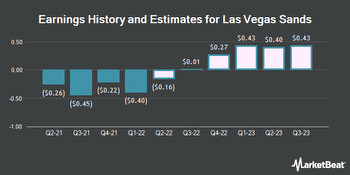

Las Vegas Sands (NYSE:LVS - Get Rating) last released its quarterly earnings data on Wednesday, October 19th. The casino operator reported ($0.27) earnings per share for the quarter, missing analysts' consensus estimates of ($0.20) by ($0.07). Las Vegas Sands had a negative return on equity of 25.33% and a net margin of 46.94%. The firm had revenue of $1.01 billion during the quarter, compared to analyst estimates of $1.01 billion. During the same period last year, the business earned ($0.45) EPS. The firm's revenue was up 17.3% on a year-over-year basis. Equities analysts anticipate that Las Vegas Sands Corp. will post -1.19 EPS for the current year.

Analyst Ratings Changes

LVS has been the topic of several recent analyst reports. Barclays upped their price target on shares of Las Vegas Sands from $43.00 to $57.00 and gave the company an "overweight" rating in a report on Thursday, December 15th. StockNews.com initiated coverage on shares of Las Vegas Sands in a report on Wednesday, October 12th. They issued a "sell" rating on the stock. Jefferies Financial Group raised shares of Las Vegas Sands from a "hold" rating to a "buy" rating in a report on Monday, September 26th. Bank of America upped their price target on shares of Las Vegas Sands from $46.00 to $52.00 in a report on Wednesday, January 4th. Finally, Wells Fargo & Company upped their price target on shares of Las Vegas Sands from $45.00 to $53.00 and gave the company an "overweight" rating in a report on Tuesday, January 3rd. One analyst has rated the stock with a sell rating, two have issued a hold rating, ten have given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $52.42.

Las Vegas Sands Profile

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Las Vegas Sands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Las Vegas Sands wasn't on the list.

While Las Vegas Sands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.