Analysts Expect Gambling.com Group Limited (NASDAQ:GAMB) to Post $0.02 Earnings Per Share

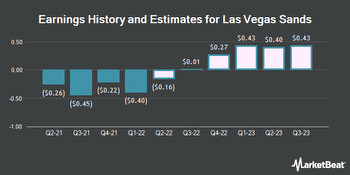

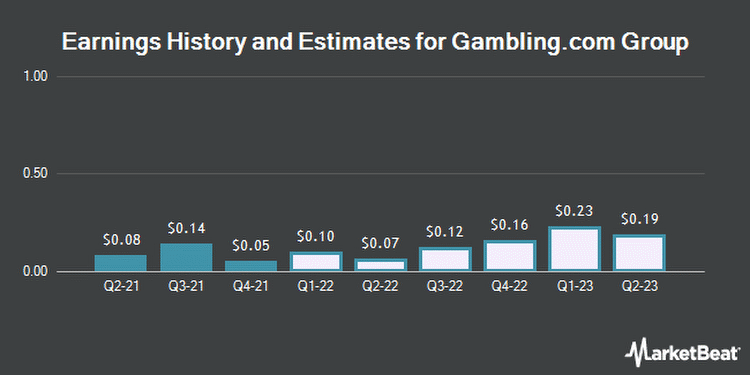

Equities research analysts predict that Gambling.com Group Limited (NASDAQ:GAMB - Get Rating) will announce earnings per share of $0.02 for the current quarter, according to Zacks Investment Research. Three analysts have issued estimates for Gambling.com Group's earnings. The highest EPS estimate is $0.03 and the lowest is $0.00. Gambling.com Group reported earnings of $0.08 per share during the same quarter last year, which would indicate a negative year-over-year growth rate of 75%. The company is expected to report its next earnings results on Monday, January 1st.

On average, analysts expect that Gambling.com Group will report full year earnings of $0.30 per share for the current financial year, with EPS estimates ranging from $0.29 to $0.31. For the next year, analysts expect that the company will report earnings of $0.69 per share, with EPS estimates ranging from $0.67 to $0.71. Zacks Investment Research's earnings per share calculations are an average based on a survey of analysts that cover Gambling.com Group.

Gambling.com Group (NASDAQ:GAMB - Get Rating) last issued its quarterly earnings data on Thursday, March 24th. The company reported $0.05 earnings per share for the quarter, beating analysts' consensus estimates of $0.04 by $0.01. The firm had revenue of $10.29 million during the quarter, compared to analyst estimates of $10.28 million. Gambling.com Group had a return on equity of 18.59% and a net margin of 24.76%.

(Ad)

If you’re new to trading, then you’ve probably heard the wrong thing about options—that they’re risky, unpredictable, or difficult.

And it couldn’t be more wrong! With the Hughes Optioneering Strategy, you’ll soon learn that the safest option for new accounts is options themselves!

Gambling.com Group stock traded up $0.35 during trading on Friday, reaching $9.52. 319 shares of the stock traded hands, compared to its average volume of 45,153. The company has a market capitalization of $321.87 million and a price-to-earnings ratio of 27.20. The business has a fifty day simple moving average of $8.16 and a two-hundred day simple moving average of $9.44. The company has a debt-to-equity ratio of 0.02, a current ratio of 5.75 and a quick ratio of 5.75. Gambling.com Group has a 52-week low of $6.56 and a 52-week high of $16.97.

Several institutional investors have recently modified their holdings of GAMB. Geode Capital Management LLC purchased a new position in Gambling.com Group in the third quarter worth about $125,000. Morgan Stanley purchased a new position in Gambling.com Group in the third quarter worth about $76,000. Potrero Capital Research LLC purchased a new position in Gambling.com Group in the third quarter worth about $592,000. Capstone Investment Advisors LLC purchased a new position in Gambling.com Group in the third quarter worth about $752,000. Finally, Millennium Management LLC purchased a new position in Gambling.com Group in the third quarter worth about $118,000. Hedge funds and other institutional investors own 25.80% of the company's stock.

Gambling.com Group Company Profile (Get Rating)

Gambling.com Group Limited operates as a performance marketing company for the online gambling industry worldwide. The company provides digital marketing services for the iGaming and sports betting. It publishes various branded websites, including Gambling.com and Bookies.com. Gambling.com Group Limited was incorporated in 2006 and is based in St.

Further Reading

For more information about research offerings from Zacks Investment Research, visit Zacks.com

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to [email protected]

Before you consider Gambling.com Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gambling.com Group wasn't on the list.

While Gambling.com Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.