Las Vegas Sands Betting On Lifted Restrictions

Las Vegas Sands (LVS) shares have been dragged down from China and Singapore imposing lockdowns and restrictions on mobility to limit the resurgence of COVID-19, and therefore are down about 8% thus far this year.

I am bullish on this stock.

But as the current wave of COVID-19 is waning, yet again, investor visibility into the future for the hospitality and entertainment industry is clearing up.

There could be a rebound in the share price, but the timing will also depend on how market conditions improve from the current bearish sentiment.

At the moment, strong headwinds from high inflation, the war in Ukraine, widespread protectionism and the risk of a recession are preventing investors from jumping back into the stock.

Certainly, LVS is cheaper today than it was a few weeks ago.

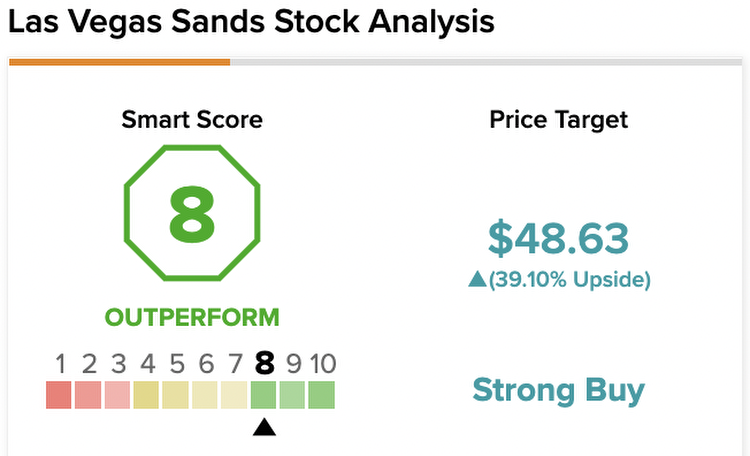

On TipRanks, LVS scores an 8 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to outperform the broader market.

About Las Vegas Sands

Las Vegas Sands is the world’s leading developer and operator of world-class integrated resorts.

Its portfolio includes one property in Singapore and five properties in China’s Macau Special Administrative Region (SAR) in the western Pearl River Delta on the South China Sea.

The company also states that it is included in the Dow Jones World and North America sustainability indices, while also being recognized by Fortune as one of the World’s Most Admired Companies.

The company’s headquarters are in Las Vegas, Nevada.

Financial Results for the First Quarter of 2022

Due to travel restrictions in Macau and Singapore to limit the resurgence of COVID-19, Las Vegas Sands saw fewer visitors in the first quarter of 2022 than in the first quarter of 2021.

Thus, revenue fell more than 20% year-over-year to $943 million in the first quarter of 2022, falling short of analysts’ median forecast by about $187 million.

By region, net revenues from Macau operations were $551 million (down 29% year-over-year), while net revenues from Marina Bay Sands operations in Singapore were $399 million (down 6.3% year-over-year).

In addition to lower revenues, Las Vegas Sands had higher interest charges on outstanding debt compared to the same quarter of the previous year.

The two things combined led to a pro forma net loss of $0.41 in the first quarter of 2022, missing the average analyst estimate by $0.17.

In addition, consolidated adjusted EBITDA of $110 million for the first quarter of 2022 was 55% lower than last year’s quarter. Capital expenditures were $137 million, of which more than 60% was allocated in Macau and the rest in Singapore.

Outlook Clearing Up

The future no longer looks as uncertain as it did just a few weeks ago, when COVID-19 infections flared up again in the People’s Republic of China and other East Asian countries, including Singapore.

Governments have imposed lockdowns and restrictions to curb the spread of the coronavirus, severely limiting opportunities for Las Vegas Sands and other resort and casino operators to welcome visitors. These measures have been depressing for the business of resort and casino operators as they rely heavily on guesttraffic and tourism.

After about two months of strict restrictions on trade and free movement of citizens, the situation in various Chinese urban areas, including Macau SAR, is gradually returning to normal.

In addition, given the location of the assets, Las Vegas Sands benefits from the Chinese government’s strong focus on developing the real economy in the Guangdong-Hong Kong-Macau Greater Bay Area.

Analysts’ Earnings Growth Estimates

Analysts estimate that Las Vegas Sands will grow its earnings per share by 50.80% this year, by 431% in 2023 and by 265.70% annually over the next few years from 2023 to 2027.

The Financial Condition

As of March 31, 2022, the company had unlimited cash balances of $6.43 billion and access to $3.48 billion in revolving credit facilities, while total debt outstanding amounted to $14.95 billion.

LVS believes its financial condition is strong enough to support investment activities and cover capital expenditures in Macau and Singapore, while seeking growth by entering new markets.

Wall Street’s Take

In the past three months, eight Wall Street analysts have issued a 12-month price target for LVS. The stock has a Strong Buy consensus rating based on six Buys and two Hold ratings.

The average Las Vegas Sands price target is $48.63, implying a 39.10% upside potential.

Valuation

Shares are changing hands at $35.46 as of the writing of this article for a market cap of $27.10 billion and a 52-week range of $28.88 to $59.59.

The stock price doesn’t look expensive as it trades below the 50-day moving average of $35.86 and significantly below the 200-day moving average of $38.98.

Currently, the share price offers a more compelling entry point than it did just a few weeks ago, increasing the likelihood of a higher return when sentiment turns bullish on the stock.

Conclusion

Lockdown and restrictions continue to affect Las Vegas Sands’ financial performance, reflecting bearish sentiment around the stock price.

Nevertheless, demand for casinos and resorts remains robust in China and Singapore, according to the company’s latest quarterly earnings report.