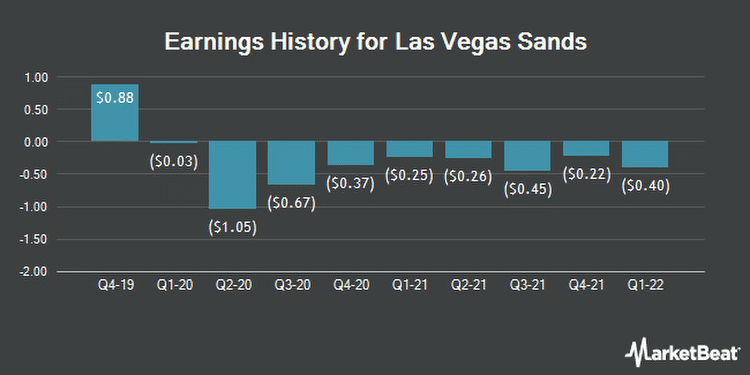

Las Vegas Sands (NYSE:LVS) Announces Earnings Results, Misses Expectations By $0.16 EPS

Las Vegas Sands (NYSE:LVS – Get Rating) released its earnings results on Wednesday. The casino operator reported ($0.40) earnings per share for the quarter, missing the consensus estimate of ($0.24) by ($0.16), MarketWatch Earnings reports. Las Vegas Sands had a negative return on equity of 40.02% and a net margin of 46.40%. The business had revenue of $943.00 million for the quarter, compared to the consensus estimate of $1.13 billion. During the same quarter last year, the business posted ($0.25) earnings per share. The firm’s revenue for the quarter was down 21.2% compared to the same quarter last year.

LVS traded down $0.25 on Friday, hitting $35.43. The company had a trading volume of 6,083,862 shares, compared to its average volume of 5,343,988. The stock has a fifty day moving average price of $38.31 and a 200-day moving average price of $39.62. Las Vegas Sands has a 12-month low of $31.26 and a 12-month high of $61.81. The company has a debt-to-equity ratio of 6.55, a quick ratio of 2.14 and a current ratio of 2.15. The stock has a market capitalization of $27.07 billion, a price-to-earnings ratio of 14.70 and a beta of 1.31.

LVS has been the subject of several research analyst reports. JPMorgan Chase & Co. upgraded Las Vegas Sands from a “neutral” rating to an “overweight” rating and lifted their target price for the stock from $36.00 to $48.00 in a research report on Tuesday, January 11th. Morgan Stanley decreased their target price on Las Vegas Sands from $44.00 to $39.00 and set an “equal weight” rating for the company in a research report on Monday, April 25th. The Goldman Sachs Group upgraded Las Vegas Sands from a “buy” rating to a “conviction-buy” rating and set a $66.00 target price for the company in a research report on Sunday, January 16th. Stifel Nicolaus decreased their target price on Las Vegas Sands from $56.00 to $46.00 in a research report on Thursday. Finally, UBS Group upgraded Las Vegas Sands from a “neutral” rating to a “buy” rating and set a $53.00 price target on the stock in a research note on Wednesday, January 19th. Two investment analysts have rated the stock with a sell rating, six have given a hold rating, five have given a buy rating and one has given a strong buy rating to the company’s stock. According to MarketBeat.com, the stock has an average rating of “Hold” and a consensus price target of $49.54.

Institutional investors and hedge funds have recently bought and sold shares of the business. California State Teachers Retirement System grew its stake in Las Vegas Sands by 4.3% in the fourth quarter. California State Teachers Retirement System now owns 621,303 shares of the casino operator’s stock valued at $23,386,000 after purchasing an additional 25,632 shares during the last quarter. State of Tennessee Treasury Department grew its stake in shares of Las Vegas Sands by 539.0% during the fourth quarter. State of Tennessee Treasury Department now owns 354,667 shares of the casino operator’s stock worth $13,350,000 after acquiring an additional 299,161 shares during the last quarter. Amalgamated Bank grew its stake in shares of Las Vegas Sands by 13.5% during the fourth quarter. Amalgamated Bank now owns 86,131 shares of the casino operator’s stock worth $3,242,000 after acquiring an additional 10,269 shares during the last quarter. Weiss Multi Strategy Advisers LLC purchased a new stake in shares of Las Vegas Sands during the fourth quarter worth about $2,258,000. Finally, Advisors Asset Management Inc. grew its stake in shares of Las Vegas Sands by 16.4% during the fourth quarter. Advisors Asset Management Inc. now owns 58,913 shares of the casino operator’s stock worth $2,217,000 after acquiring an additional 8,293 shares during the last quarter. Institutional investors own 34.33% of the company’s stock.Las Vegas Sands Company Profile (Get Rating)

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.