Zacks: Brokerages Anticipate Las Vegas Sands Corp. (NYSE:LVS) to Announce -$0.19 EPS

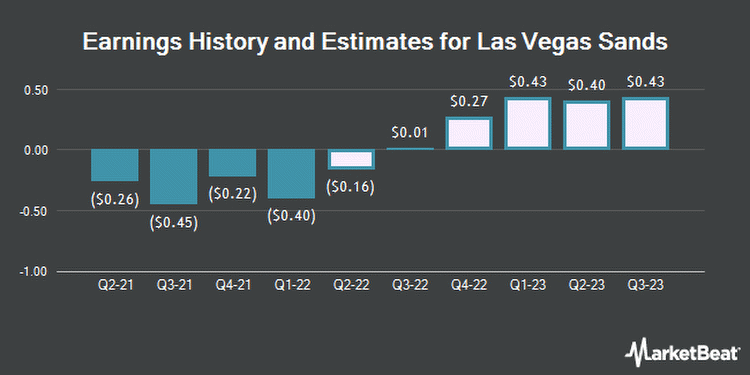

Brokerages expect Las Vegas Sands Corp. (NYSE:LVS – Get Rating) to report ($0.19) earnings per share for the current quarter, according to Zacks Investment Research. Five analysts have provided estimates for Las Vegas Sands’ earnings. The highest EPS estimate is ($0.03) and the lowest is ($0.29). Las Vegas Sands reported earnings of ($0.26) per share during the same quarter last year, which would indicate a positive year over year growth rate of 26.9%. The company is expected to report its next quarterly earnings report on Monday, January 1st.

On average, analysts expect that Las Vegas Sands will report full year earnings of ($0.64) per share for the current financial year, with EPS estimates ranging from ($0.94) to ($0.24). For the next year, analysts expect that the business will post earnings of $1.65 per share, with EPS estimates ranging from $0.67 to $1.94. Zacks Investment Research’s EPS calculations are an average based on a survey of sell-side research analysts that follow Las Vegas Sands.

Las Vegas Sands (NYSE:LVS – Get Rating) last issued its quarterly earnings results on Wednesday, April 27th. The casino operator reported ($0.40) EPS for the quarter, missing the consensus estimate of ($0.24) by ($0.16). The firm had revenue of $943.00 million for the quarter, compared to analysts’ expectations of $1.13 billion. Las Vegas Sands had a negative return on equity of 33.07% and a net margin of 46.40%. The firm’s revenue for the quarter was down 21.2% compared to the same quarter last year. During the same quarter in the previous year, the firm posted ($0.25) earnings per share.

Several equities research analysts recently issued reports on the company. Deutsche Bank Aktiengesellschaft cut their price objective on Las Vegas Sands from $60.00 to $53.00 in a report on Thursday, April 28th. Stifel Nicolaus cut their price objective on Las Vegas Sands from $56.00 to $46.00 in a report on Thursday, April 28th. Morgan Stanley cut their price objective on Las Vegas Sands from $44.00 to $39.00 and set an “equal weight” rating on the stock in a report on Monday, April 25th. StockNews.com upgraded Las Vegas Sands to a “sell” rating in a report on Tuesday, May 10th. Finally, Zacks Investment Research upgraded Las Vegas Sands from a “sell” rating to a “hold” rating and set a $42.00 price objective on the stock in a report on Monday, April 4th. Two equities research analysts have rated the stock with a sell rating, six have assigned a hold rating, five have issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the stock has an average rating of “Hold” and an average price target of $49.54.Hedge funds and other institutional investors have recently made changes to their positions in the stock. NEXT Financial Group Inc boosted its position in shares of Las Vegas Sands by 68.0% in the 4th quarter. NEXT Financial Group Inc now owns 877 shares of the casino operator’s stock valued at $33,000 after purchasing an additional 355 shares during the period. Mizuho Securities Co. Ltd. acquired a new stake in Las Vegas Sands during the 1st quarter worth approximately $39,000. Hudock Inc. lifted its position in Las Vegas Sands by 89.9% during the 1st quarter. Hudock Inc. now owns 1,056 shares of the casino operator’s stock worth $41,000 after acquiring an additional 500 shares during the period. Desjardins Global Asset Management Inc. acquired a new stake in Las Vegas Sands during the 4th quarter worth approximately $40,000. Finally, Confluence Wealth Services Inc. acquired a new stake in Las Vegas Sands during the 4th quarter worth approximately $40,000. 34.33% of the stock is owned by hedge funds and other institutional investors.

Las Vegas Sands stock opened at $34.62 on Monday. Las Vegas Sands has a 52 week low of $28.88 and a 52 week high of $59.59. The business’s fifty day simple moving average is $35.89 and its 200-day simple moving average is $38.71. The firm has a market cap of $26.45 billion, a PE ratio of 14.37 and a beta of 1.28. The company has a quick ratio of 3.13, a current ratio of 3.14 and a debt-to-equity ratio of 3.19.

About Las Vegas Sands (Get Rating)

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

Featured Articles