Casino Stocks Rally As Macau Gambling Revenues Come In Strong

You'll be asked to sign into your Forbes account.Got it

You'll be asked to sign into your Forbes account.Got itWhile investors greeted the first day of 2023 trading with big selling in classic tech favorites like Apple and Advanced Micro Devices, buyers showed up in large numbers among the classic casino names. This, after Macau reported “gross gaming revenues” increased 333% in 2023 versus 2022.

Those U. S. names with significant exposure in “The Las Vegas of the East,” rallied at the open and held on to the gains by the close of Tuesday’s trading. The report from Macau’s “Gaming Inspection and Coordination Bureau” came as the South China Sea destination had begun to ease Covid 19 restrictions.

Las Vegas Sands owns Sands Macao, a 289-suite resort/casino on 229,000 square feet. The late Sheldon Adelson once said that the China-based Sands operations, which opened in 2004, would eventually bring in more money than the Las Vegas properties.

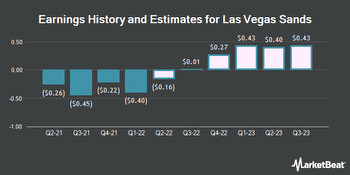

The company, including all global operations, has a market capitalization of $38.67 billion. Earnings this year are up by 264% and for next year analysts estimate growth of 51%. Debt exceeds shareholder equity by just over 3 times. Las Vegas Sands pays a .53% dividend.

Here’s the daily price chart, with today’s 4.31% gain in the red circle:

MGM Resorts International owns and operates MGM Macau in a 50/50 partnership with Pansy Ho, the Hong Kong/Canadian billionaire, graduate of Santa Clara University and daughter of Macau resident and businessperson Stanley Ho. It’s a 600-room casino/resort inside of a 35-story building with swank restaurants and, outside, a golf course.

Market capitalization for the whole company comes to $15.54 billion. The stock trades with a price-earnings ratio of 15.51 and at 3.3 times book. The debt-to-equity ratio is 8.01. The past 5-years shows earnings growth of .88% and this year’s earnings are up by 184%. MGM does not pay a dividend.

The daily price chart, showing today’s 1.79% gain, is here:

WYNN Resorts owns Wynn Macau where tourists can stay in the 1008 rooms available in 2 towers. The first tower, Wynn, opened in 2006 and the second tower, Encored, opened in 2010.

The company has a market capitalization of $10.69 billion and a negative book value. Earnings this year are showing growth of 172% and analysts expect to see 46% EPS improvement next year. Wynn pays a .77% dividend.

You can see today’s 3.83% gain on this daily price chart:

VICI Properties is not exactly a casino stock but since it leases the property that Caesars and a few other Las Vegas properties sit on, the real estate investment trust joined in the fun — even with no Macau exposure.

Take a look at the daily price chart with the 2.45% gain and a “bullish engulfing” type of candlestick:

It’s almost as if the algorithms just headed for the entire sector — or closely related sectors — on the news.

John Navin's Newsletter | Substack