Las Vegas Sands Took a Macau Hit. Why Singapore Can Help.

For investors willing to roll the dice on travel stocks, Las Vegas Sandsgot another vote of confidence Wednesday.

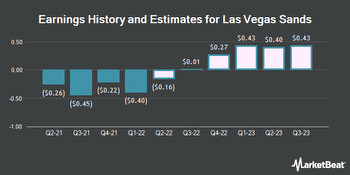

With another quarter in the books without a Macau reopening, J.P. Morgan analyst Joseph Greff lowered his estimates for Las Vegas Sands(ticker: LVS). And although he writes that this “is not at all surprising to investors,” he also boosted his estimates for Singapore, which he thinks might come as a surprise.

He reiterated an Overweight rating on Las Vegas Sandswhile tweaking his price target down $4 to $42, arguing that while Macau—and the ongoing delays to its reopening—grab the headlines, that obscures the importance of the company’s Manila Bay Sands (MBS) property.

Greff estimates that Singapore accounts for about half of Las Vegas Sands’ current market cap. “Our sense is that when we point this out to investors, they are surprised it is that high and the general perception is that Macau is the majority of the current equity value (and it was in the past when Macau was in its strong performing periods, prepandemic),” he writes.

Moreover, his math shows that the stock only trades at 9.4 times enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) for MBS, using his forward property EBITDA estimate of $1.465 billion. “We can remember a time when investors (and us, too) were ascribing 15x plus multiples to Singapore, even when its past EBITDA growth slowed given capacity constraints there.”

Greff, like other analysts, isn’t counting on a comeback for Macau until next year at least, but argues the market is underappreciating Singapore in the meantime, and isn’t seeing decelerating revenue/EBITDA trends, like U.S. gaming and lodging companies.

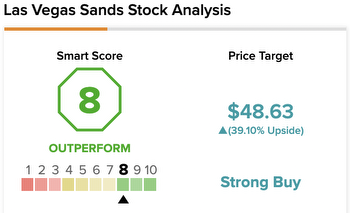

Barron’s has for Las Vegas Sands, and other analysts have also gotten recently, arguing it could climb higher once the casino relicensing process ends later this year.

Two-thirds of analysts tracked by FactSetare bullish on Las Vegas Sands, with an average price target of $47.20.

The shares were up 0.2% in Wednesday morning trading. The shares are off 7.5% in 2022, but after being a dark horse among travel stocks—which boomed last year with a U.S. reopening even as China’s zero-Covid policy remained firmly in place—Las Vegas Sands has held up better this year. It’s loss is only about half of the S&P 500’s in 2022, while the Consumer Discretionary Select Sector SPDR (XLY) has fallen by nearly a third.