Las Vegas Sands Stock (NYSE:LVS) Should Continue Skyrocketing on China’s Reopening

Invariably, a hot-streaking enterprise like Las Vegas Sands (NYSE:LVS) raises concerns about whether it can continue skyrocketing. Obviously, no one wants to buy at the peak only to hold the bag later. However, Las Vegas Sands may indeed overcome objections based on a key catalyst: China, China, China. Therefore, I am bullish on LVS stock.

Naturally, enthusiasm for the casino and resorts stalwart – along with the rest of the industry players – blossomed, first with the news that China’s government was relaxing controls associated with the pandemic and second, with Beijing finally relenting and reopening its economy. Of course, China oversees gaming mecca Macau under the principle of “one country, two systems.”

For LVS stock and its ilk, restoring Macau to its pre-pandemic glory represented the primary (and basically only) prayer. Without Macau, Las Vegas Sands was a jetliner seeking an appropriately sized airport to land on. Indeed, for LVS, the stakes couldn’t be higher.

As I wrote in August last year, the company made a “mistake” relying on Macau. In 2021, management sold its namesake regional properties for $6.25 billion as it shifted its focus to Macau and Singapore. Longer term, the sale made sense as the growth potential in Asia presents a more promising narrative for LVS stock.

However, the divesting also meant that Las Vegas Sands ironically couldn’t make money in Las Vegas. With every penny counting, the decision hurt LVS stock. Fortunately, China’s reopening couldn’t come a moment too soon.

LVS Stock to Benefit from a Favorable Gambling Culture

To be sure, LVS stock presents emotionally pressing concerns about possible bag holding. Since the January opener, LVS stormed to a nearly 20% lead. In the trailing year, shares bounced up over 32%. Much of this enthusiasm stemmed from the past six months, with the stock gaining over 56%. Still, Las Vegas Sands deserves its premium because of Macau’s gambling culture.

Fundamentally, the company positioned itself to reap the rewards of an incredibly favorable framework regarding revenue composition. I emphasized this point regarding Las Vegas Sands competitor Wynn Resorts (NASDAQ:WYNN). Basically, it’s the same compelling catalyst for both.

For Las-Vegas-centered properties, the revenue distribution (gaming, food/lodging, and entertainment) tends to be balanced along these subsegments. Stated another way, when tourists visit Vegas casinos, they’re not just there to test Lady Luck. Instead, they’re also in Sin City to indulge in lobster dinners and take in a magic show.

However, with Macau properties, the focus overwhelmingly centers on gambling, and that’s wonderful news for Las Vegas Sands. Essentially, each dealer and each machine can extract multiple sessions of revenue generation per hour.

In sharp contrast, as I stated earlier (in the article linked above), “a lobster can only be eaten once, while a room can only be rented to a single guest or group at a time.”

From another angle, investors should consider this point: because Macau patrons focus mostly on high-revenue-generation activities, Las Vegas Sands stands a better chance of making up for lost time rather than diluting the waters with Sin City. Finally, management’s wager paid off for LVS stock.

Ignore the Current Noise

Admittedly, when prospective investors view the present financials undergirding LVS stock, they won’t like what they see. For instance, the market prices LVS at a trailing multiple of 24.58. Regarding the forward multiple, the metric is much more expensive at nearly 60.

Operationally, the top line (outside of context) suggests deep challenges. The casino’s three-year revenue growth rate (on a per-share basis) pings at -31.8%. Its book growth rate during the same period similarly rates poorly.

Obviously, though, these substandard figures represent background noise. With China reopening, all attention will now focus on LVS stock regaining lost ground.

Indeed, if investors wanted to consider one metric above the others, it’s this: during the fourth quarter of 2022, casino revenue at The Venetian Macao hit $130 million, representing nearly 65% of total sales at the resort. Once circumstances normalize, investors should see such allocations at scale.

Is LVS Stock a Buy, According to Analysts?

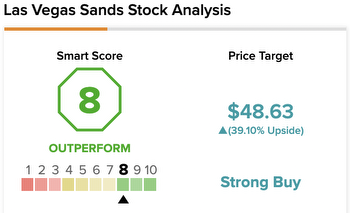

Turning to Wall Street, LVS stock has a Strong Buy consensus rating based on 14 Buys, two Holds, and zero Sell ratings. The average LVS stock price target is $63.22, implying 7.3% upside potential.

Additionally, on TipRanks, LVS stock has a ‘Perfect 10’ Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

The Takeaway: LVS Stock is Just Getting Started

Although the casino and resorts industry suffered some of the worst damage following the COVID-19 crisis, the sector stands poised to recover dramatically thanks to China’s economic reopening. Fundamentally, the focus of Macau gamblers to concentrate on high-revenue-generating activities bodes incredibly well for LVS stock.