Is Las Vegas Sands Stock A Buy With Macau On Cusp Of Recovery?

Las Vegas Sands (NYSE:LVS) stock has fared well over the last quarter or so, rising by about 40% since the end of October 2022. The recent gains come as two major overhangs relating to the Macau business – which accounted for over 60% of the company’s pre-pandemic revenue – appear to be easing. Firstly, China’s State Council has been rolling back some Covid-19 restrictions, scaling back on mass testing, quarantine requirements, and the use of the health code system. This could help to drive a recovery in the Macau casino market, which has seen gaming activity trend at a fraction of 2019 levels amid a dramatic decline in tourist inflows. Moreover, LVS and five of its peers have won provisional licenses to continue operating in Macau over the next 10 years. The Macau government also rejected a bid from another potential player who wanted to enter the market. The conditions under which the licenses were offered also appear to be quite reasonable, with the Macau government requiring casino players to ensure local employment, attract foreign tourists, and expand their non-gambling offerings. This should help to ease some of the regulatory headwinds surrounding the stock.

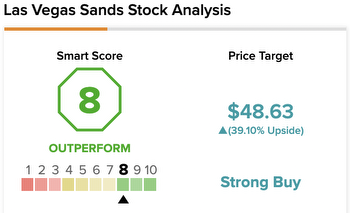

So what’s the outlook like for LVS stock? LVS’s financial performance has already been picking up in recent quarters. Over Q3, revenues expanded by about 17% year-over-year, while net losses also narrowed. Growth has been driven by the Marina Bay Sands (MBS) property in Singapore which is seeing a surge in demand. MBS sales were up almost 3x year-over-year in Q3 and things are likely to remain strong, given Singapore’s reputation as a stable and high-value market. Moreover, the eventual recovery in Macau should also help LVS significantly, given that the company has over 12,000 rooms that can cater to the considerable pent-up demand. The company’s liquidity position is also reasonable, with cash holdings standing at $5.8 billion as of September 2022. That being said, there are risks as well. The recent surge in Covid-19 cases in China could delay the return of tourists to Macau to a certain extent, while the global economy also faces headwinds amid rising interest rates. LVS is also quite highly leveraged, with over $15 billion in total debt outstanding. We value LVS stock at about $49 per share, which is roughly in line with the current market price. See our analysis of Las Vegas Sands valuation

What if you’re looking for a more balanced portfolio instead? Our high-quality portfolio and multi-strategy portfolio have beaten the market consistently since the end of 2016.