Las Vegas Sands Stock Strength Rising

There are no sure bets in Las Vegas. Its nickname "Lost Wages" is no coincidence. But one thing is sure; the house always wins in the long run. And on Monday, Las Vegas Sands (LVS), the world's biggest casino company with a market cap of nearly $30 billion, earned an upgrade to its stock Relative Strength (RS) Rating, from 73 to 85. The 85 rating puts Las Vegas Sands stock in the top 15% of stocks, regardless of industry, for price performance.

Market research shows that the top-performing stocks often have an RS Rating north of 80 as they begin their biggest price moves. The new 85 RS Rating for Las Vegas Sanks is a bullish indicator. However, the Vegas-based casino giant, which operates casinos in its hometown as well as in Singapore and several in Macau, has some work to do to get into the top tier of stocks.

Las Vegas Sands Stock Near Flat Base Entry

Among its other key ratings, Sands has a strong 86 EPS Rating of a best-possible 99. That's based mainly on strong, earlier profits. It has a milder 66 Composite Rating, and its C- Accumulation/Distribution Rating, on an A+ to E scale with A+ tops, shows that funds and other institutions will need more convincing before they dive in.

Las Vegas Sands stock is working on a flat base with a 40.08 entry. See if it can clear the breakout price in volume at least 40% above average. On Monday, Sands rose 1.5% to 38.75.

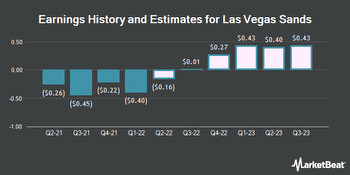

In terms of fundamentals, Las Vegas Sands reported a 34 cent loss last quarter, vs. a 26-cent loss the same quarter last year. Revenue dipped 11% to $1.045 billion in its most recent quarter. However, that showed improvement for both EPS and revenue, on a quarter-over-quarter basis.

Peers In Casinos Group

Las Vegas Sands earns the No. 11 rank among its peers in the Leisure-Gaming/Equipment industry group. Small caps Canterbury Park (CPHC) and Monarch Casino & Resort (MCRI) are also among the group's highest-rated stocks.

As you try to find the best stocks to buy and watch, be sure to pay attention to relative price strength.

IBD's unique Relative Strength Rating tracks price movement with a 1 (worst) to 99 (best) score. The rating shows how a stock's price behavior over the trailing 52 weeks compares to all the other stocks in our database.