On Wednesday, Las Vegas Sands (LVS) will report its quarterly earnings.

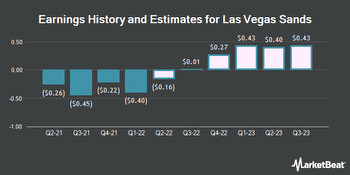

Las Vegas Sands (NYSE: LVS) will release its results report for the prior quarter on Wednesday, October 19, after the stock market has closed. There is a general agreement among those who follow the market that Las Vegas Sands will report a loss of $0.20 per share for the third quarter.

On July 20, Las Vegas Sands (NYSE: LVS) released their most recent quarterly earnings report. The casino operator reported earnings per share for the quarter of $0.34, which was lower than industry analysts’ predictions, who anticipated earnings of $0.25 per share for the quarter. The sales for the company during the quarter came in at $1.05 billion, which was significantly higher than the $949.40 million that analysts had anticipated the company would bring in during the period. The Las Vegas Sands had a net margin of 45.39 percent, even though the company had a negative return on equity of 31.93%. Las Vegas Sands’s revenue for the previous year’s equivalent quarter was 10.9% lower than what it brought this year. The company incurred a $0.26 per share during the same period the year before. Analysts think Las Vegas Sands will make $1 per share in the next fiscal year. The company is expected to make $1 per share in the current fiscal year.

When the stock market opened on Monday, the price of a share of Las Vegas Sands was $35.22 per share. The stock price has maintained a moving average of $36.16 over the past 200 days, while its moving average over the last 50 days has been $38.00. A debt-to-equity ratio comes in at 3.63, a current ratio comes in at 3.35, and a quick ratio comes in at 3.33. The company’s market capitalization is currently sitting at $26.91 billion, its price-to-earnings ratio stands at 15.45, and its beta value sits at 1.15. Las Vegas Sands has seen its stock price go as low as $28.88 over the past year, while it has reached a high of $48.27 during the same period.

Institutional investors have been active buyers and sellers of company shares most recently. During the first three months, Wetherby Asset Management Inc. added 222,000 dollars worth of stock in Las Vegas Sands to its holdings. Verition Fund Management LLC increased its stake in Las Vegas Sands by 5586 percent during the second quarter. After acquiring an additional 7,759 shares during the most recent quarter, Verition Fund Management LLC now has 6,370 shares of the casino operator’s stock valued at $214,000 in its possession. These shares were acquired for the first time during the quarter before this one (up from 6,020). During the first three months of the year, Prudential PLC established a new holding in Las Vegas Sands by purchasing shares for 262,000 dollars. In addition, Edgestream Partners L.P. spent $293,000 to acquire new ownership in Las Vegas Sands, which they did so by purchasing new shares. During the first three months of the year, this investment was made.

Last but not least, during the first three months of this year, Toroso Investments LLC added 5.2% more Las Vegas Sands stock to its holdings, bringing the total percentage of the company’s stock that it possessed to 100%. As a result of the company’s purchase of an additional 458 shares over the preceding three months, Toroso Investments LLC now directly owns 9,348 shares of the casino operator’s stock. Based on the stock’s current price, this gives the company a value of $363,000. Institutional investors currently hold ownership of 39.84% of the company’s shares as of right now.

By writing reports, a multitude of equity analysts has contributed to the body of work that has been done on the company. In a research report that was made public on Thursday, July 21, JPMorgan Chase & Co. announced that they would be raising their price objective on Las Vegas Sands from $42.00 to $44.00. In a research report published that day, Jefferies Financial Group changed its rating for Las Vegas Sands from “hold” to “buy.” Bank of America has lowered its rating on Las Vegas Sands from “underperform” to “neutral” and has established a price objective of $37.00 for the company, both of which were announced in a research note that was made public on Thursday. Deutsche Bank Aktiengesellschaft stated in a research note that was made public on Tuesday, July 19, that they would be lowering their price objective for Las Vegas Sands from $53 to $50. The new price objective is $50. Finally, on October 12, StockNews.com published a research note on the company, marking the beginning of the publication website’s coverage of Las Vegas Sands. They recommended “selling” the stock to prospective buyers. There was one market analyst who rated the stock as a “sell,” three others who rated it as a “hold,” nine others who rated it as a “buy,” and one analyst who rated it as a “strong buy.” According to information from Bloomberg.com, the price goal for Las Vegas Sands has been set at $48.11, and the general recommendation for the company is “Moderate Buy.”

Through its subsidiary companies, Las Vegas Sands Corporation is engaged in developing integrated resorts in the United States and Asia. The company also owns and manages integrated resorts in both regions. In addition to the Cotai Strip and the Sands Macao in Macao, the People’s Republic of China, and the Marina Bay Sands in Singapore, it owns and manages The Venetian Macao Resort Hotel, The Londoner Macao, The Parisian Macao, The Plaza Macao, and the Four Seasons Hotel Macao. Its other properties include the Parisian Macao and the Four Seasons Hotel Macao. The Parisian Macao is one of the other properties under its management.