g2g.news

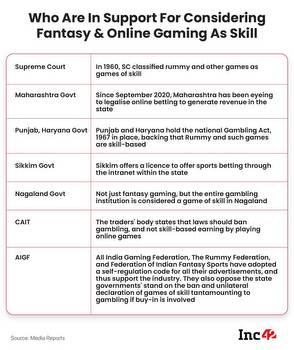

AIGF applauds CCPA advisory against illegal online gambling endorsements by celebrities

The

All India Gaming Federation

(AIGF) has praised the Central Consumer Protection Authority (CCPA) for its advisory warning celebrities and influencers against promoting betting and gambling firms. This advisory, issued under the Consumer Protection Act, aims to crack down on the proliferation of advertisements promoting illegal offshore gambling…