Single tax rate for online gaming ‘desirable’ to avoid litigation: report

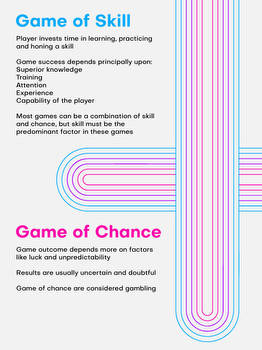

There is an overlap on games of skill and games on chance. This could be the key towards a uniform tax rate for India's online gaming industry.

In May, a seven-member group of ministers was convened by the GST Council to examine and address taxation issues related to the online real money games India sector. The issue was the different tax rates levied to segments under the umbrella of gambling. For instance, the standardized goods and services tax (GST) places a 28 percent tax rate on entertainment events, including casinos and race courses. However, skill-based gaming is currently levied an 18 percent GST.

The All India Gaming Federation wants the 18% tax rate for skill-based online games to continue. The Supreme Court has already ruled that online gaming is based on skill. The GoM is expected to submit its report in November. Then the GST Council will discuss all the issues related to gambling and take a considered view. If done correctly, the review on gambling tax may pave the way forward towards the uniform legalization of India’s online gambling industry.