What You Need to Know About Gambling and Your 2021 Taxes

The deadline for filing 2021 federal tax returns looms on April 18 this year. Gambling income is reported as a gross figure and not a net result. The standard deduction for married couples filing a joint return for tax year 2021 is $25,100. For single taxpayers and married individuals filing separately, the standard deductions is $12,550 and $18,800. For those who gamble relatively modestly, they have no opportunity to deduct any gambling losses. It is not financially viable to itemize deductions. A gambling loss can be deducted only if it is less than the sum of the gambling win and the loss of money.

All gambling winnings must be reported as income. Gambling income is reported on Schedule 1 and then carried over to Form 1040, Line 8. Taxpayers must itemize to get the benefit of a gambling loss deduction. If gambling losses are taken as a deduction, they cannot exceed the amount of gambling wins.

All gambling winnings must be reported as income. Gambling losses are accounted for on Schedule A, Itemized Deductions. The state taxes may be due on gambling wins and losses. The rules vary from state to state. Gamblers should familiarize themselves with their state’s tax policies on the gambling income and keep a journal of their gambling activity.

Gambling is a legal activity that should be recorded in your record-keeping. All gambling winnings are reportable even if the operator doesn't issue paperwork.

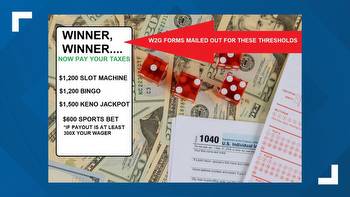

The W-2G should be issued by the gambling operator on certain occasions. The winnings are not reduced by wager, but reduced at least 300 times the amount of the wagers. They are subject to federal income tax withholding. Gambling activity is treated differently from day-trading stocks.

Gambling is not reduced by the wager. It is reduced at the option of the payer by at least 300 times the amount of wagers. The winnings are subject to federal income tax withholding.

The American Gaming Association is concerned about the unfairness of the 2017 tax code to taxpayers who gamble. AGA has been trying to get the threshold for issuing W-2Gs raised from $1,200 to $5,000 without any luck. The current $1000 threshold has not been adjusted for inflation since 1977. The Congressional Gaming Caucus advanced an effort to raise the slot tax threshold to $5000 with bipartisan legislation.

Some states allow for deductions for losses and for gambling winnings. Most do not. Mississippi has a 3% "nonrefundable" tax on gambling wins. Non-U.S. casino customers from outside the country get different treatment.