You bet you'll pay taxes: Bingo & sport betting wins are income

Certain amounts require a W2G to be sent to you, but all winnings count as additional income.

Certain amounts require a W2G to be sent to you, but all winnings count as additional income.GREENSBORO, N.C. — Bingo, slots, sports betting. Whatever you played and won in 2022, the IRS wants to know about it when you file taxes in 2023.

“Their winnings are income. It's pure and simple. You need to report that income on your 1040 or you will get a letter from the IRS saying that you underreported your income and you might not like the results,” said Shane Albrecth, Liberty Tax General Manager.

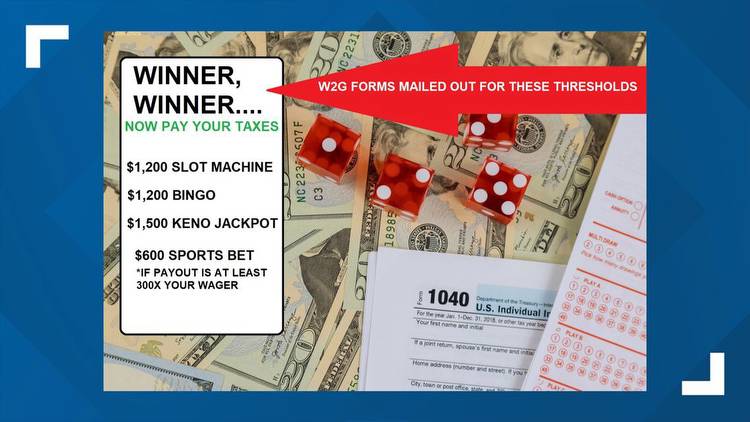

Gaming organizations are supposed to send you a W2G if you won a certain amount on certain games.

$1,200 on a slot machine or Bingo$1,500 in a KENO jackpot

$600 on a sports bet if your payout is at least 300 times your wager

The W2G mailed to you is also mailed to the IRS as well.If you don't get anything in the mail, are you free?

Nope. Under Gambling Winnings, it says that you must report all gambling winnings including winnings that aren't reported on a form W2G.

Now, the upside to having to pay for winnings is that you can write off your losses if you itemize.

“If you lose $12,000 and only won $6,000, your deduction is $6,000, the other $6,000 just goes away,” said Albrecth.

If you won money or prizes, you're using a 1040 form to tell the IRS about it, the Additional Income is a Schedule 1 form. By the way, unemployment and jury duty pay are also considered additional income and are taxed.

On the IRS website, it says:

The following rules apply to casual gamblers who aren't in the trade or business of gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.