Here's How Gambling Winnings Are Taxed

Don't subject yourself to hefty penalties by forgetting to pay taxes on your winnings.

Key points

- Any gambling winnings are subject to federal income tax.

- If you win more than $5,000 on a wager, and the payout is at least 300 times the amount of your bet, the IRS requires the payer to withhold 24% for income taxes.

- Any gambling losses can offset your gambling winning as long as you meet certain criteria.

Hit a lucky streak in Vegas? Hit it big in PowerBall? Made some money in your fantasy football league? If so, you may be subject to taxes on your winnings. Many people don't think about paying taxes on their gambling winnings. In most cases, any money won from gambling activities is considered taxable income and must be reported on your tax return. But how does the IRS determine how much in taxes you owe on your winnings? Let's take a look.

What is considered gambling income?

Gambling income refers to any money or the fair market value of prizes you have earned through activities involving chance or skills. These activities can include slot machine gaming, betting on sports, horse racing, lottery tickets, and more. The Internal Revenue Service (IRS) requires taxpayers to declare their gambling income when filing taxes. This means that all winnings must be reported, regardless of the amount. It is important to keep accurate records of gambling income, because failure to do so can result in income tax penalties from the IRS.

How much do you owe?

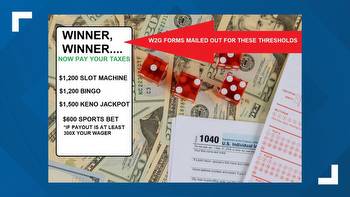

The amount of tax you owe depends largely on the amount of money that you win, the type of gambling, and the ratio of the winnings to the wager. Generally speaking, if your winnings are more than $600 (and at least 300 times the cost of the wager) then it will be reported to the IRS by the entity that paid you. This means that if you win more than $600 playing blackjack, for example, then the casino may have to report this information directly to the IRS. The number increases to $1,200 in gambling winnings from bingo or slot machines, $1,500 or more from Keno, and $5,000 from a poker tournament.

For gambling winnings over $5,000, taxes are generally withheld at a flat rate of 24%. If you did not provide your Social Security number, they may withhold 31%. The full amount of your gambling winnings for the year must be reported on Line 21 of Form 1040. However, if you itemize deductions on your tax return and claim losses (up to the amount of your winnings), then you may be able to deduct your losses on Line 27, Schedule A (Form 1040). Your gambling loss deduction cannot be more than your gambling winnings.

It is important to keep an accurate account of your gambling winnings and losses. To deduct your losses, you must be able to provide proof. These can include receipts, tickets, bank statements, or other records. By taking some time now to familiarize yourself with these rules and regulations regarding taxation of gambling winnings, it could help you save money and time down the road when it's time to file your tax return.

If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our experts even use it personally. for free and apply in just 2 minutes.