Did you gamble during Diwali? Here’s how winnings are taxed

Gambling is legal in India but it draws a tax. In some parts of the country, playing cards with friends and family is a big part of Diwali celebrations.

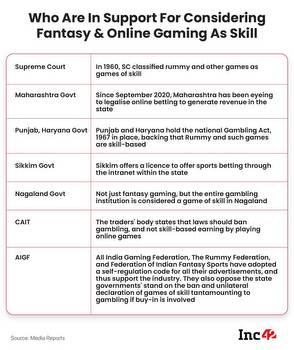

Gambling and betting are state subjects in India. The legal status of online fantasy sports games is still unclear. Niti Aayog has categorized them as a game of skill. Most states have broadly regulated betting and gambling under the Public Gambling Act, 1867. Some states, like Assam and Odisha, don't give this exemption. Karnataka, Andhra Pradesh and Telangana have prohibited any games of skills played for stakes. In Sikkim and Nagaland, a licence is required.

Wins from card and other games are taxable at 30%. Online platforms deduct applicable TDS before crediting the prize money in the player’s bank account. If the total winning amount exceeds ₹10,000, T DS of 30% needs to be deducted by the distributor. If platform fails to do so, the onus of reporting the winning income and paying due taxes on it is on the taxpayer.