Las Vegas Sands Corp. to build Long Island casino resort

Las Vegas Sands Corp. is proposing to build a multibillion-dollar resort on Long Island, New York, as part of a bid for one of three downstate New York casino licenses.

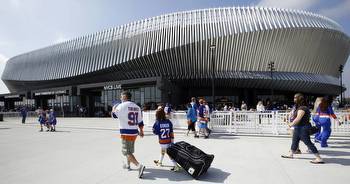

Las Vegas Sands said Thursday it has entered into agreements to purchase the long-term lease of the site that’s currently home to the Nassau Veterans Memorial Coliseum. The transactions, which still require certain regulatory approvals, would grant the company control of up to 80 acres in Nassau County, New York, according to the news release.

Sands, meanwhile, also is expected to be a key player in efforts to legalize casino gambling in Texas. Legislation was introduced in the state’s legislature in November to amend its Constitution to allow gambling as well as introduce sports wagering.

Competition for the three New York licenses will be intense. Several Las Vegas companies and others with Nevada connections have announced plans to bid for licensing in New York.

Last week, the state’s Gaming Facility Location Board approved its rules and issued a request for applications, which requires a $1 million entry fee for the licenses.

Companies that have expressed interest in a New York gaming license are Las Vegas-based MGM Resorts International, the Strip’s largest operator; Reno-based Caesars Entertainment Inc., the second-largest operator of Strip casino properties; Wynn Resorts Ltd., which has two Strip resorts and Encore Boston Harbor in Everett, Massachusetts; Genting Group, operators of Resorts World Las Vegas; Hard Rock International, owned by the Seminole Tribe of Florida, which now owns The Mirage; Bally’s Corp., operators of the Tropicana Las Vegas; and Chicago-based Rush Street Gaming.

New York Sen. Joe Addabbo, D-Queens, who chairs the committee on racing, gaming and wagering, said two operators of existing casinos near New York City would likely have an inside track in the awarding of the new licenses.

Genting Group’s Resorts World New York City is attached to the Aqueduct Racetrack and opened in 2011, after the legislature authorized slot machines at racetracks in 2001. The property has more than 6,500 slots and automated table games. The new license would permit live table games.

The Empire City Casino at Yonkers Raceway, operated by MGM, also has slot machines and automated tables.

Caesars announced in October a partnership with New York office landlord SL Green Realty Corp. to open Caesars Palace Times Square in an existing skyscraper.

The 54-story tower is owned by SL Green and the new Caesars Palace would be designed to include a Broadway theater for “The Lion King,” according to a news release, which did not provide other details on the proposed project.

Wynn is partnering with New York real estate heavyweight Related Companies at its Hudson Yards development in Manhattan. A release issued by Wynn said the property would be a resort, entertainment and gaming destination along the Hudson River, and it would be near the sprawling Javits Center.

Another strong bid is being made by Legends, affiliated with the MLB’s New York Yankees, the Chickasaw Nation Indian Tribe and Saratoga Casino Holdings at Coney Island in Brooklyn.

Meanwhile, New York Mets owner Steve Cohen has indicated that he hopes to develop an entertainment complex that would include a casino in Queens on property near Citi Field, home of the Mets. New York media outlets previously reported Sands as a potential partner in Cohen’s project, but Thursday’s announcement dismisses those reports.

A boost for Long Island

“We strongly believe Long Island can be home to one of the region’s great entertainment and hospitality developments,” Sands Chairman and CEO Rob Goldstein said in a release. “Our announcement is only the first part of this journey. Our ability to put forward a compelling and competitive proposal will only succeed if we engage with the Long Island community and, in collaboration, develop a proposal that reflects the input of all those involved.”

The Long Island development would include outdoor community spaces, four- and five-star hotel rooms and a live performance venue honoring the legacy of live music at the Nassau Coliseum.

The company said the resort would also feature celebrity chef restaurants, experiential events and venues, and flexible meeting and convention space, including ballrooms. Its casino gaming offering would represent less than 10 percent of the project’s total square footage, according to the release. There are also plans to have a day spa, swimming pool and health club.

The process of selecting three licensees in New York has just begun and there’s no formal deadline for the submission of application.

The Gaming Facility Location Board set a Feb. 3 deadline for questions from interested parties.

Enthusiasm for Texas

In Texas, meanwhile, Sands has long supported legislative efforts to legalize gaming in the state and has hired an army of lobbyists to back legislation filed by Sen. Carol Alvarado, D-Houston. Under her legislation, four destination resorts and sports betting would be allowed in the state. It would also expand gambling at racinos and tribal casinos. The state already has a lottery in place.

Four cities that could potentially house integrated resorts are Dallas-Fort Worth, Houston, San Antonio and Austin.

Last year, Goldstein expressed the company’s enthusiasm for gaming in Texas in an emailed statement.

“Our commitment is to develop transformational destination resorts that create tens of thousands of jobs and produce billions in revenue for the state while also providing robust economic benefits to the local host communities,” Goldstein said at the time. “Destination resorts have proven to be excellent drivers of economic growth and enhanced tourism, and we are excited about the possibility of bringing the concept to the Lone Star State.”

But there’s still plenty of opposition to the plan based on moral grounds. While Gov. Greg Abbott appears to now favor casino gaming, Lt. Gov. Dan Patrick, who presides over the state Senate, continues to express his opposition.

Like Nevada, the Texas Legislature convenes every other year and started its 88th 140-day session Tuesday with adjournment calendared for May 29.

The Review-Journal is owned by the Adelson family, including Dr. Miriam Adelson, majority shareholder of Las Vegas Sands Corp., and Las Vegas Sands President and COO Patrick Dumont.

rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.