Las Vegas Sands paid $241 million for Nassau Coliseum site lease

Taking another step toward a casino bid, Las Vegas Sands has paid a total $241 million to acquire a lease to control the Nassau Coliseum site, according to a new company filing.

The price tag included a $92 million “goodwill” premium — more than the property’s true value, according to the company’s quarterly report filed Oct. 20 with the U.S. Securities and Exchange Commission.

The filing said the $241 million was paid to Nassau Live Center LLC, headed by Nicholas Mastroianni II, which had controlled the property.

The Nassau County Legislature in May approved a 99-year lease agreement that would allow Las Vegas Sands to build a casino on the Coliseum site if the company were to win one of three available state licenses for a downstate casino. The SEC filing also shows Sands made an initial $54 million payment to Nassau County, and that its future “minimum lease payments” will be $1 million for 2023, $6 million annually from 2024-27 and $1.77 billion “thereafter.”

WHAT TO KNOW

- Las Vegas Sands has paid $241 million to acquire a lease to control the Nassau Coliseum site, according to a new company filing.

- The price tag included a $92 million “goodwill” premium — more than the property’s true value, according to a report filed with the U.S. Securities and Exchange Commission.

- The Nassau County Legislature has approved a 99-year lease agreement that would allow Las Vegas Sands to build a casino on the Coliseum site, if Sands wins one of three available state licenses for a downstate casino.

Newsday reported previously that Sands had closed on the lease deal, although the dollar amount hadn’t been disclosed.

In the filing, the company stated:

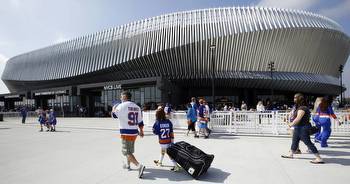

“On June 2, 2023, we paid $241 million to acquire Nassau Live Center, LLC and related entities (the ‘Nassau Coliseum’), the owners and operators of an entertainment arena in the State of New York. The purchase of the Nassau Coliseum, which continues to operate following the closing of the sale, primarily included the fixed assets related to the arena and the right to lease the underlying land from the owner, the County of Nassau in the State of New York.”

A Sands spokeswoman confirmed details of the company’s SEC filing and said the agreement gives the company 100% control of the lease. The company didn’t provide any other comments or outline why it agreed to the $92 million “goodwill” premium.

In a recent interview on CNBC, the financial news cable channel, Sands CEO Robert Goldstein said: “We control the Nassau Coliseum, almost 70 acres, and I think we’re going to build a top-tier resort of the highest order.”

A casino at the old Coliseum isn’t a done deal. Sands is competing with many other companies for one of just three available casino licenses. At least 10 entities have said they intend to bid, with Sands the lone expected bidder east of Queens.

Among competitors for downstate casino licenses are Resorts World at Aqueduct Racetrack and Yonkers Raceway/Empire Casino.

Yonkers and Aqueduct already have video slot machines but a state gambling license would allow traditional Vegas-style table gambling, such as blackjack and poker, in addition to slot machines and video gambling.

A year ago, some experts thought the state Gaming Commission might select winning bids in 2023, but the process has moved slowly and is all but certain to roll into 2024.

Further, Sands’ proposal in Nassau would require a zoning change to create a new “hospitality” district in Uniondale, according to land-use plans the company filed with Hempstead Town.

Asked on CNBC about possible property issues, Goldstein said: “We have both control of the property and we are approaching the zoning very seriously and our bid will be very, very strong.”

The zoning application seeks to integrate the 72-acre “Nassau Hub” with nearby property where the Long Island Marriott hotel is located. Current zoning doesn’t permit a casino at the Coliseum site. Sands also could need zoning changes related to height, setbacks and parking.

Sands has said its plans include a casino, two hotels and a 4,500-seat live performance venue.

Mastroianni, in an interview Thursday, said he and investors held “debt of approximately $120 million” on the Coliseum site as various plans over the past decade failed to come to fruition. Mastroianni said his group sold the lease to Sands at a discount even though he believes it’s worth at least $350 million, now that the company has a 99-year lease.

“Am I relieved? Hmm, yeah,” Mastroianni said. “But what I’m happy to see is a company with financial strength behind the project. So no matter what happens there, they have the wherewithal to build it.”