Long Island officials reach agreement to lease Nassau Coliseum to Sands for casino bid

Nassau County officials said Wednesday that they have reached a deal to transfer the lease for the Nassau Coliseum site to Las Vegas Sands, a major step in the gambling giant’s push to win a coveted gaming license and bring a bustling casino to Long Island.

The 99-year lease agreement does not guarantee that the Uniondale site where the New York Islanders once played will someday host hordes of gamblers.

The deal requires signoff from the Nassau County Legislature. And the casino bid faces growing local pushback, including a Hofstra University lawsuit that aims to derail the concept.

But the preliminary agreement detailed Wednesday further solidified a bid that has been seen as a front-runner in the state’s high-stakes casino sweepstakes.

“This could become the highest-grossing casino in America,” Nassau County Executive Bruce Blakeman said at a news conference. “We want to use that money for good things: to stabilize our tax base, to make sure we don’t have to raise taxes, to make sure we have quality construction jobs.”

The state-run bidding process, which began in January, is set to deliver three $500 million downstate casino licenses to deep-pocketed developers. But two licenses are widely expected to go to existing so-called racinos in Yonkers and southeast Queens, leaving at least nine competitors vying for the final license.

The Long Island casino would land at the siteof the coliseum, a 16,000-seat former NHL arena now used for graduations, G League basketball and professional box lacrosse. In 2021, the Islanders relocated to the new UBS Arena in nearby Elmont.

It is unclear if the half-century-old coliseum would be demolished to make way for the casino.

Sands has said it plans to build a casino and resort with restaurants, ballrooms and a live performance venue on the 72-acre plot, which is about 7 miles from the eastern edge of Queens.

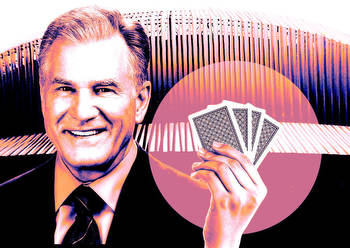

“We don’t build casinos,” Robert Goldstein, chief executive of Sands, said at the news conference with Blakeman. “We build resorts with casinos inside of them.”

“This will be, if we do it, the best hotel in New York,” Goldstein promised.

Under the lease agreement, Sands would pay about $60 million in the first year of the contract — regardless of the outcome of the bidding process — and then some $100 million a year if it wins the license, according to Nassau County.

Sands appears to have built-in advantages in the bidding process.

The Sheldon Adelson-founded firm is flush with cash. Former Gov. David Paterson is a top executive at Sands. And the location of the site, beyond the teeming streets of the five boroughs, could spare it some of the blistering community criticism that city concepts have attracted.

Still, the Long Island bid has hardly been immune from pushback.

Early this month, about 50 locals opposing the bid held a rally outside the Nassau County legislative building, The Long Island Press reported.

And the nearby village of Garden City passed a resolution last week opposing the casino plan. Garden City’s mayor, Mary Carter Flanagan, said Wednesday that she was concerned about traffic, drunken driving and other crimes linked to casinos.

The mayor said she was “terribly disappointed” by the lease agreement, panning it as a “money grab.”

“We will fight this proposal aggressively as long as it takes to convince our local and statewide leaders that they must say no to the casino,” she said in an interview.

Hofstra, one of the coliseum’s most powerful neighbors, has taken the Nassau County Planning Commission to court in an effort to halt the bid.

In court papers filed in Nassau County Supreme Court, Hofstra said the commission had denied the school sufficient opportunity to provide feedback on the proposed lease transfer.

“Hofstra University and its students and staff have a keen interest in avoiding the risks of gambling addiction, crime, excessive traffic and environmental dangers associated with casinos,” said the complaint from Long Island’s largest private university.

Sands was not a party to the suit. A spokesman for the county, Christopher Boyle, said in a statement that university officials “would be better off spending their students’ tuition on education rather than frivolous lawsuits.”

New York City bids require two-thirds approval from panels with representatives of the mayor, the governor, the local Assembly member and state senator, the local City Council member and the local borough president.

The Long Island plan would be scrutinized by a panel with representatives of the governor, the county executive, the local Assembly member and state senator and the town supervisor.

At the Wednesday news conference, the Sands chief executive acknowledged the complexity and competitiveness of the process.

“What we need, of course, is a license in New York State — I have no idea how to handicap how that works,” Goldstein said. “We need all the help that we can to convince the people who make that decision that Nassau County deserves this.”