Gaming stock falls up to 5% after withdrawing IPO as 28% GST on Casinos will be Implemented from October 01

A gaming company’s share price plummeted 8 percent to reach an intraday low of ₹ 181.10 apiece on the National Stock Exchange (NSE) after an announcement in the 51st meeting of the GST Council on August 02, 2023, regarding Goods and Services Tax (GST) on online gaming, casinos and horse racing.

At 12:36 PM, Delta Corp’s shares were trading at ₹ 186.90 apiece, down 5.18 percent. Its share price has fallen by more than 25 percent in the past month.

Union Finance Minister Nirmala Sitharaman post the 51st meeting of the GST Council said the 28 per cent Goods and Services Tax (GST) on online gaming, casinos and horse racing is expected to be implemented from October 1 this year.

Sitharaman said that the GST Council has recommended that the valuation of online gaming and actionable claims in casinos may be done based on the amount paid or payable to or deposited with the supplier, by or on behalf of the player (excluding the amount entered into games or bets out of winnings of previous games or bets) and not on the total value of each bet placed.

The Finance Minister added that the 28 percent tax on casinos and online gaming would be reviewed after the completion of six months after implementation.

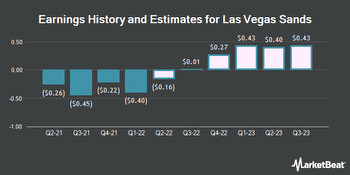

Delta Corp’s Casino Gaming Segment reported an EBITDA of ₹ 101 crore, representing an impressive margin improvement of over 1,000 basis points sequentially and over 100 basis points on a year-on-year(YoY) basis.

Earlier, Delta Corp in a press release said that it is hopeful and confident that a mutually amicable and favourable outcome will emerge, with regard to the recent GT council outcome, given the kind of representations and concerns being raised by both online gaming and casino industry, coupled with investor community and some States.

In another development, the company had put plans of taking its online gaming unit public on hold due to uncertainties pertaining to the GST rate increase on the sector, MoneyControl reported on August 01.

Delta Corp CFO Hardik Dhebar said that the IPO is on hold and the company will revisit this plan once complete clarity emerges.

With a market capitalization of ₹ 5,278 crores, Delta Corp is a small-cap company. It has a low return on equity of 12.33 percent and an ideal debt-to-equity ratio of 0.03. Its shares were trading at a price-to-earnings ratio (P/E) of 19.43, which is lower than the industry P/E of 34.24, indicating that the stock might be undervalued as compared to its peers.

Retail investors hold a 42.12 percent stake in the company, followed by promoters with 33.28 percent, mutual funds with 17.92 percent and foreign institutions with 6.68 percent.

To stay updated with the Latest Stock Market news, download our app here!

For editorial purposes, contact news@tradebrains.in

Start Your Stock Market Journey Today!

Want to learn Stock Market trading and Investing? Make sure to check out exclusive Stock Market courses by FinGrad, the learning initiative by Trade Brains. You can enroll in FREE courses and webinars available on FinGrad today and get ahead in your trading career. Join now!!