Skill gaming and the future of real money gaming

Missed the GamesBeat Summit excitement? Don't worry! Tune in now to catch all of the live and virtual sessions here.

Nancy MacIntyre, CEO of Game Taco, gave a quick rundown of the skill-gaming market and the future of real-money games at our recent GamesBeat Summit 2023 event.

MacIntyre became the CEO of Game Taco in May. Game Taco bought the skill-based gaming publisher Worldwinner from Sony in May 2021. Worldwinner itself got started in skill games in 1999, and last year, Game Taco partnered with FanDuel to develop a new product.

She said that Game Taco runs over nine million tournaments every month and it has given out over $2 billion in cash prizes to date. Most of the business is on the mobile gaming platforms, which are on track to hit $90 billion in 2023, MacIntyre said.

One thing that’s relevant to the skill gaming business is that 50% of the revenues in mobile gaming are driven by casual games, including sports games and casino games.

“Those are really the foundation for the skill business, and the skill gaming categories are outpacing growth of the greater game sector,” MacIntyre said.

Last year, the skill-gaming business did about $10 billion and represented around 8% of the overall gaming category, she said. That’s expected to grow to nearly 15% of total mobile games by 2025.

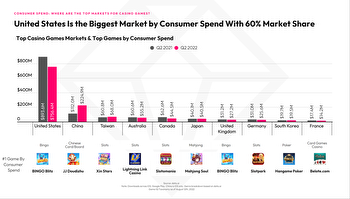

The top skill gaming markets start with the US but we’ve got India, Mexico, the United Kingdom and Germany round out the top five on a global basis. There are regulations in various markets that make it more complex to launch skill games around the world than just launching in the app store.

“But we’re beginning to see new markets in Europe, Latin America, and more that are embracing skill gaming and we do expect that to continue to grow significantly,” MacIntyre said.

There’s a lot of competition in skill gaming. Skillz and Mobile Premier League are likely the most well-known skill-gaming companies, but MacIntyre said no single company dominates the business. Other players besides Game Taco include Papaya, Pocket7Games and GameDuell. The latter was acquired by India’s MPL in 2022.

“There’s a fight for the hearts and minds of skill-gaming players around the world,” MacIntyre said.

The category is a lot different compared to premium or subscription games, as the games are played in multiplayer matches against other people. The games also aren’t random, like gambling games. They take either physical skill or mental skill to win.

“It’s like the difference between playing chess or playing roulette,” she said. “There is no chance or luck involved in these games. It is really all about skill.”

Otherwise, they would be classified as gambling and would be subject to regulations. Skill gaming is considered separate from gambling in at least 40 states in the U.S.

The players are matched via skill levels to ensure that there’s a fair environment for players. The sharks and the minnows don’t fight in the same pool, as that isn’t fair. And in skill games, players can win real-money prizes.

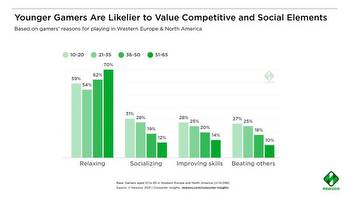

Skill gaming also has a broad customer demographic. In its early days, it was considered a category of games played by soccer moms who liked casual games. Today, about a third of players are over 45. It’s a wide demographic, with 55% of the players being women.

“When you contrast that to the classic video game business, which has begun to expand over years to include people of all ages, this category tends to have many more older users and many more people that are playing casual games,” MacIntyre said.

“And what’s interesting about these players is that they are gamers with a capital G, even though they don’t necessarily define themselves as gamers,” she said. “They spend more time playing games than other gamers — almost 40 hours a month — and they’re playing cross-platform. While mobile might be their dominant platform for play, they’re also playing PC games or playing games on tablets or playing games on console.”

They also spend more money, with average hitting $76 a month per skill gamer compared to $48 a month for a typical gamer.

“It way outpaces the spending of traditional gamers,” MacIntyre said. “So these are very engaged, loyal and dedicated players.”

Not surprisingly, skill gamers also like to gamble. About 75% of skill gamers also play scratch-offs, Powerball casino products, slot machines, and fantasy sports, she said. Players feel that skill games with a cash component are more fun than casual games that don’t have that element.

“They have skin in the game,” she said. “Because mobile game players have grown up playing a range of games and adapted their gameplay, they have moved from playing games with other people in esports to the next frontier of playing games for money.”

She added, “It’s a big opportunity there from a market perspective. We’ve also learned that the market is rather fragmented with no dominant global brand. There’s lots of expansion and growth.”

GamesBeat's creed when covering the game industry is "where passion meets business." What does this mean? We want to tell you how the news matters to you -- not just as a decision-maker at a game studio, but also as a fan of games. Whether you read our articles, listen to our podcasts, or watch our videos, GamesBeat will help you learn about the industry and enjoy engaging with it. Discover our Briefings.