PlayAGS Appears Well Positioned For Casino Rebound (NYSE:AGS)

A Quick Take On PlayAGS

PlayAGS (NYSE:AGS) reported its Q3 2022 financial results on November 12, 2022, beating revenue and EPS estimates.

The firm provides electronic gaming machines and online gaming to the gaming industry in the U.S. and overseas.

While AGS appears positioned to benefit from a more robust and 'normal' casino business environment, there isn't much visibility as to when that benefit will show up in the financials.

Until we gain greater trend visibility, I'm on Hold for PlayAGS.

PlayAGS Overview

Las Vegas, NV-based PlayAGS was founded in 2005 as a commercial gaming supplier. AGS offers electronic slot machines, table games and equipment, and social online casinos for B2B and B2C.

Management is headed by President and CEO David Lopez, who has been with the firm since 2014. Lopez was previously the President of Global Cash Access from 2012 - 2014 and COO of Shuffle Master from 1998 - 2011.

PlayAGS offers products in three segments: Table Products, Interactive Social Casino Games, and Electronic Gaming Machines [EGM]. The company is a leading designer and supplier of EGMs and related products and services.

The company's geographic focus has been North America with office locations in California, Texas, Nevada, Oklahoma, and Georgia. AGS has hundreds of employees around the globe including Australia, Israel, and Mexico.

PlayAGS's Market

According to a 2022 market research report by Data Bridge Market Research, the Global Casino Gaming Equipment market size was an estimated $7.1 billion in 2021 and is forecast to reach $11.1 billion by 2029.

This represents a projected CAGR (Compound Annual Growth Rate) of 5.5% during the period of 2022 to 2029.

The main factors driving the market's growth are the growing popularity of reconfigurable electronic gaming machines and an increase in casino gaming worldwide.

Also, due to being user-friendly and easily upgradeable to different games, EGMs are gaining popularity in modern casinos.

A key market challenge is the availability of substitutes such as lotteries, horse race betting, sports betting, and casino games. Constant innovation is required in the industry to remain competitive.

The company went public in January 2018 at a price of $16.00 per share.

PlayAGS's Recent Financial Performance

Total revenue by quarter has risen according to the following chart:

Gross profit margin by quarter has trended lower in recent quarters:

Selling, G&A expenses as a percentage of total revenue by quarter have also trended lower more recently:

Operating income by quarter has grown in recent reporting periods:

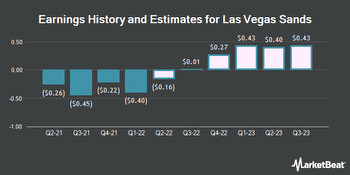

Earnings per share (Diluted) have turned positive recently:

(All data in the above charts is GAAP)

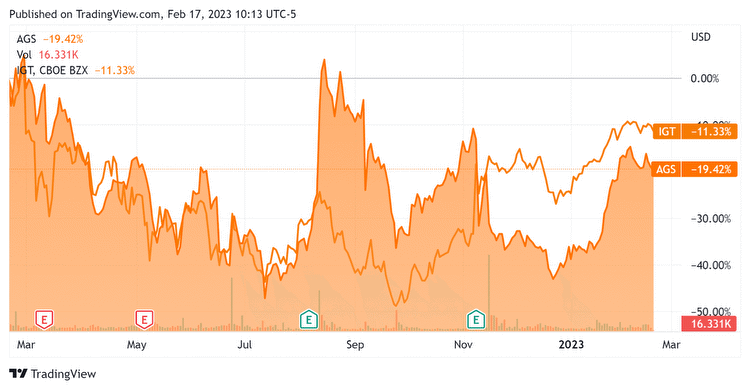

In the past 12 months, AGS's stock price has fallen 219.4% vs. that of the International Game Technology PLC's drop of 11.3%, as the chart indicates below:

Valuation And Other Metrics For PlayAGS

Below is a table of relevant capitalization and valuation figures for the company:

(Source - Seeking Alpha)

As a reference, a relevant partial public comparable would be International Game Technology PLC (IGT); shown below is a comparison of their primary valuation metrics:

(Source - Seeking Alpha)

In its last earnings call (Source - Seeking Alpha), covering Q3 2022's results, management highlighted the improving recurring revenue aspects of the firm's business mix due to the expansion of its premium game offerings.

The company also noted the launch of its Spectra gaming cabinet, 'with a reported performance at nearly 3x house average.'

AGS has revamped its game development team, providing 'added depth and variety' for its growing content portfolio.

As to its financial results, total revenue rose 16.3% year-over-year, while gross profit margin dipped, likely due to a shift in activity toward the 'for sale' market with lower margins than the recurring revenue model.

Management did not disclose any company retention rate metrics.

SG&A expenses continued to moderate, assisting the firm's results for operating income and earnings per share.

For the balance sheet, the company ended the quarter with $43.1 million in cash, equivalents and short-term investments.

Over the trailing twelve months, free cash flow was $31.1 million, of which capital expenditures accounted for a hefty $45.6 million. The company paid $16.4 million in stock-based compensation in the last four quarters.

Management said it doesn't expect additional casino closings after a period of some scale reduction due to the pandemic.

Also, supply chain challenges appear to be moderating to some degree, although inflation continues to hurt margins.

As the casino business continues to return to more normal seasonal activity, the firm's business cadence may do so as well.

However, the higher interest rate environment is affecting its bottom line with higher debt service costs.

Regarding valuation, the market is valuing AGS at a similar EV/Revenue multiple as a much larger IGT, despite AGS's faster growth rate.

The primary risk to the company's outlook is an economic slowdown reducing consumer discretionary spending and causing gambling operators to slow their system purchases, elongating sales cycles in the process.

A potential upside catalyst to the stock could include a 'short and shallow' macroeconomic drop or a pause to Federal Reserve interest rate increases, removing upward pressure on cost of capital assumptions.

Looking ahead is a bit of a mixed bag for AGS. On the one hand, it appears to have a solid new cabinet with the Spectra combined with all seven of its content studios in full gear producing more and better quality content.

On the other hand, macroeconomic conditions are cloudy at best and the firm (and stock) is disadvantaged by the higher cost of capital environment, both in terms of its higher interest expense and lower valuation assumptions.

While AGS appears positioned to benefit from a more robust and 'normal' casino business environment, I'm just not sure when that benefit will show up in the financials.

Until then, I'm on Hold for PlayAGS.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.