Mint Primer: The gamble with online gaming: ₹1.5 trillion in taxes?

The Directorate General of GST Intelligence (DGGI) is serving tax demands worth thousands of crores of rupees on online gaming firms. The demands are up to 10x the revenue of some firms. Why is it making such astronomical demands, and are they substantiated?

How much is the DGGI claiming?

On 12 September, the DGGI’s show-cause notice to Mumbai-based Dream11 claimed GST in line with gambling and lottery firms. It claimed taxes of ₹217 crore against Dream11’s FY18 revenue of ₹228 crore, and ₹1,006 crore against FY19 revenue of ₹802 crore. In September last year, it asked Bengaluru-based Gameskraft for ₹21,000 crore GST against its FY22 revenue of ₹2,112 crore. Three lawyers for multiple gaming firms, as well as a senior government official, confirmed more such notices in works—including Games24x7. The total tax claim from the entire industry may reach ₹1.5 trillion, they said.

Is there a the case for DGGI?

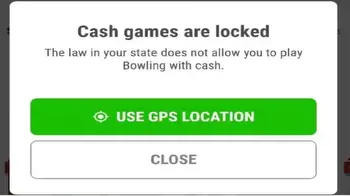

In its September 2022 claim against Gameskraft, the DGGI said that the startup misrepresented its business category, and that it is actually a gambling and not gaming firm. A lawyer for a top gaming firm said the DGGI is filing retrospective claims based on the Centre’s new 28% tax rate on the sector. Its notice to Dream11 said “the entire contest entry amount constitutes the value of taxable supply"—reaffirming that while gaming firms computed tax at 18% (the previous tax rate) of their net earnings, DGGI’s computation is based on 28% of their gross revenue. This can be 15-16x what firms have so far paid in taxes.

How is this difference being calculated?

If a gaming startup receives ₹100 from a user as a fee to play a game, they earned around ₹10 as ‘platform fee’. Prior to the new tax, startups were paying GST at 18% on this ₹10—or ₹1.80. The new tax regime mandates GST at 28%. This takes up the DGGI’s tax claim up 15 times, compared to how companies had so far computed tax, a substantial difference.

How has the gaming industry reacted?

Three top lawyers labelled the tax claims as disproportionate, since the demand exceeded the revenue of these firms. Two other lawyers said Dream11 is likely to receive retrospective claims of up to ₹40,000 crore, as against its FY22 revenue of ₹4,056 crore. Games24x7, which reported FY22 revenue of ₹1,169 crore, may get a demand of ₹19,000 crore. An executive at an online gaming firm said finance minister Nirmala Sitharaman did not recommend retrospective claims following the 51st GST Council meeting on 2 August.

Is there any legal basis for the claims?

Lawyers said the claims are reminiscent of the government’s retrospective tax claim of ₹11,218 crore on Vodafone, plus penalties of ₹7,900 crore. In gaming, courts, including the Supreme Court, said these startups offer games of skill, which is not gambling. This is why a retrospective GST claim at the same level as gambling is being debated. Segregation of games of skill and chance should also help differentiate startups such as Gameskraft, Dream11 and Games24x7 from gambling and lottery entities.

Catch all the Corporate news and Updates on Live Mint.Download The Mint News App to get Daily Market Updates & Live Business News.