GST on betting and gambling: Tax structure and liabilities in case of default

Gambling and betting, whether online or offline, are supplies of services as per the goods and services tax (GST) law. Currently, an 18 per cent GST is levied on online Games of skill, while a 28 per cent GST is levied on online games of chance

Taxability in GST

According to Archit Gupta, Founder & CEO, Clear, GST is computed on gross gaming value or stake instead of the gross gaming revenue (total collection minus winnings distributed) or service fee. Hence, a 28% GST is charged and collected on betting and gambling under the HSN code 999692 on the total stake or bet value.

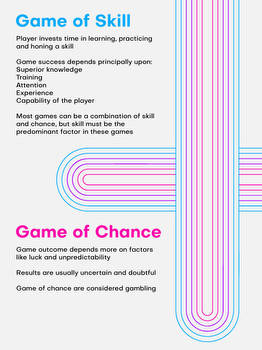

Online Games of Chance and Skill

Betting and gambling are games of chance that differ from the game of skills such as e-sports and some card-based games. Game of skills attracts 18% GST under HSN 998439 on a commission fee.

What happens in case of default in gambling and betting?

In gambling/betting, GST is collected on gross gaming value or stake value. Hence, GST collection is secured despite the players winning/losing.

“Some of the online skill-based games such as Rummy are being wrongly classified as betting and gambling. Retaining a high GST rate for betting or gambling would give rise to a parallel black market and potentially hamper foreign direct investment (FDI) into the online gaming industry," said Gupta.

I-T notices being sent to winners of online games for short-payment of tax

The income tax department has started issuing notices to individuals who have played and won online games, CBDT Chief Nitin Gupta had earlier said. The I-T department action comes close on the heels of the GST intelligence wing issuing a show cause notice earlier this month to a Bengaluru-based online gaming portal GamesKraft Technologies Pvt Ltd demanding ₹21,000 crore in taxes, interest and penalty.

GST collections in September surges 26 per cent

The gross revenue from GST surged by 26 per cent year-on-year to ₹1,47,686 crore in September 2022, as per the government data released on Saturday.

According to the data released by the Union Ministry of Finance, the gross GST revenue collected in the month of September 2022 is ₹1,47,686 crore of which CGST is ₹25,271 crore, SGST is ₹31,813 crore, IGST is ₹80,464 crore (including ₹41,215 crore collected on import of goods) and Cess is ₹10,137 crore (including ₹856 crore collected on import of goods).

Catch all the , , Events and Updates on Live Mint.Download The to get Daily Market Updates.