Is Evolution Gaming a Stock for the Long Haul?

Evolution Gaming Group is a Swedish company that is powering many of the live casinos popping up online around the world. The company is generating top-of-the-line profit margins with its unique, scalable business model.

Evolution Gaming is a business-to-business (B2B) operator for the live casino market. It operates live-streamed rooms and licenses the software and tables to online casinos like DraftKings or Penn National Gaming. The company has six studios in Europe and two in North America. It has a 10% take rate from its customers. In the United States, live casinos need to have tables physically located in each state to operate legally within those borders.

Evolution Gaming has the best-in-class profit margins. Its games can scale to hundreds or even thousands of players at one table. Revenue grew 53% to $669 million in 2020, but EBITDA grew even faster, up 82% for the full fiscal year.

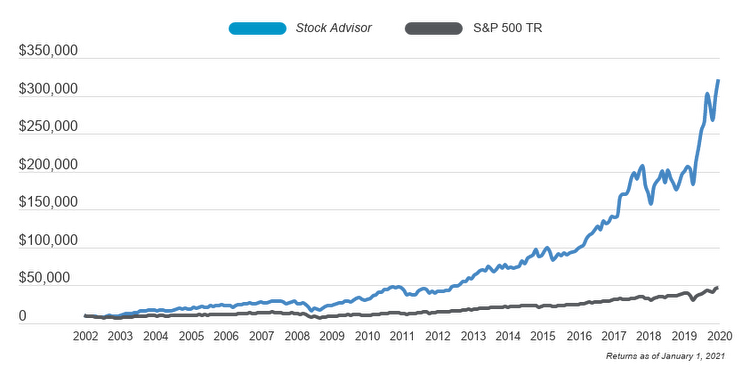

Evolution Gaming has a market cap of $24.6 billion and a P/S ratio of 36.8. It has an EBITDA multiple of 66.7. The company has clear growth prospects over the next five years. If the company can grow profits for many years to come, it may be one to hold for the long haul.

Evolution Gaming is a stock with a long-term growth potential.