Why This Online Gambling Stock Is a Buy Right Now

Paysafe is the biggest payment processor in iGaming. It serves some of the world's leading bookmakers and virtual casinos. The company is breaking into the U.S. market through both new and existing partnerships. Its stock is down 55% from its highs.

Paysafe is a London-based company that owns Skrill, a digital wallet, and Neteller, which facilitates payments between consumers and merchants. Paysafes business is growing fast in the U.S. market. It processes 100% of the volume for regulated online poker, casinos, sports betting, iLottery games in Canada. The company has an existing commercial relationship with Flutter Entertainment, who's growing its online sports gambling subsidiary in Michigan.

Paysafe's second-quarter revenue grew by 13%. The company has a global agreement with Microsoft to facilitate payments on the Xbox platform. Payment volume in the company's North American iGaming business grew 72% year over year in second quarter. The business represents a big opportunity for growth. Paysafes customers include Wynn Resorts' WynnnBET, Golden Nugget, and Parx Interactive.

Paysafe is the global leader in the iGaming payments industry. In March, the company signed a deal to use the leading cryptocurrency exchange to add crypto to its Skrill digital wallet. The company is expected to make a profit this year of $0.03 per share. Its market capitalization is $6 billion, but it trades at 4 times sales. Long-term investors can expect the stock to reach its all-time highs near $20 in a couple of years.

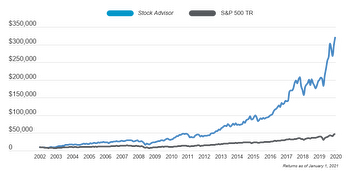

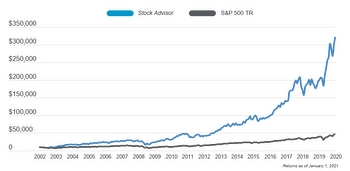

Stock Advisor launched in February of 2002. The current list price is $199 per year.