How to Play the Best Casino in the World

This house pays out 9% per year.

However, the world's largest casino yielded +9% per year over the last 100+ years of business. Billions of dollars are bet every business day. And why not? "It is a sure thing."

The name of the biggest and best casino in the entire world is [drumroll]

The U.S stock market

What's that, you say? You already knew that? Darn!

The market capitalization of listed U.S. companies is shown by year since 1975. The total value has been growing, adjusted for inflation, by 9% per year since 1975.

The above historical data justified the claim that the U.S. stock yielded +9% per year over the last 45 years.

I credited the growth of the U.S. Capital Market to productivity growth.

I developed and hold the thesis that the leading driver of productivity is transforming technology innovation into assets.

An exchange-traded fund (ETF) is a type of pooled investment security that operates much like a mutual fund. ETFs can be purchased or sold on a stock exchange precisely like a regular stock.

Finally, in the above article, I promoted the importance of ETFs, which are funds that track a market exchange, stock sector, or stock strategy. Most EFTs are indexes, and you choose the type of index with as much or more care than choosing stocks.

Most of us need to change our investment process because:

- A wide variety of ETFs have been appearing over the last fourteen years;

- These ETFs have proven to outperform portfolio managers;

- ETFs have significantly lower fees and management costs than investment firm portfolio managed funds;

- The ETFs represent the weighted decisions of all portfolio managers in all investment firms, where the weight represents the best decisions because of competitive evolution (theory).

If you seek diversification, you can do no better than an ETF. An ETF comprises many different stocks AND a broad number of decisions.

Note (soapbox): All financial advisors I know of either work for or receive commissions from investment firms. It is not a coincidence that "financial advisors" advise high-cost portfolio funds from these same investment firms. That is not to say no financial advisors are advising ETFs. I just do not know any. Corralory: I do not know any company 401k plans that offer EFTs.

We recapped my argument that we should invest in ETFs, eliminating the cost of financial advisors.

The rest of this article focuses on how to bet (invest). I (and others) recommend a "Let-er-ride" investment strategy.

Given:

- no knowledge of the current state of the financial market;

- no knowledge about the past behavior of the financial market;

- Investment in an index of a stock market yields, on average, 9% per year.

That is all you know. Well, you know a lot. You know

The stock market yields, on average, 9% per year

But, how do we invest?

Let-er-ride Investment Strategy

No matter what your age, if you have some capital or even if you have none, I recommend you start investing with the "let-er-ride" strategy.

The "let-er-ride" strategy is also called the "basic investment" strategy.

A "basic investment" is one where you start with an initial principal and invest equal amounts every period invest at an annually compounded rate of return.

The strategy is to contribute your invested capital per month or no more infrequently than once a year.

A grand casino, in this case, the U.S. stock market pays out, on average, a compounded rate of return of 9% per year.

An essential aspect of the "let-er-ride" strategy is that you do not "time" the market. Another way to say this is, "Please don't time the market." A commanding way to say this is "DON'T EVER TRY AND TIME THE MARKET."

The Let-er-ride Formula

P is the initial principal in the investment account. C is the amount of the contribution invested at the end of the period. Y is the yield per period. T is your tax rate per period. N is the number of periods where the "^" means N is an exponent and F.V. is the future value of your investment.

Note: Equation 1 assumes the same equal yield for each period. Equation 1 is an approximation as the monthly or yearly yield of stock equity fluctuates. I will show later a method for calculating “future value” where the yields vary over time.

Let-er-ride Example 1, Taxable Contribution

If, at age 30, you make an after-tax contribution of $4,800 per year to a market index for 35 years. Your effective tax rate is 21% per year on the gain from an average yield of 8.5% per year. Your tax burden reduces your effective yield to 6.375%. After 35 years, your investment is worth $580,000.

An online tool as an alternative to Equation 1. is found here.

Let-er-ride Example 2, IRA Contribution

The "qualified" money you put into an IRA deducts from your federal taxable income. You pay income tax when you take out money from your IRA.

The common IRA ( individual retirement account) is the Roth IRA. Your 2022 "qualified" 'Roth IRA contribution limit is $6,000 if you are under 50 or $7,000 if you are 50 or older. Watch out, and there is a caveat to the amount you can contribute. You can only deduct from your federal income tax up to your adjusted gross income (AGI).

If your AGI is $ 50,000 a year, you can ignore the AGI on your maximum contribution. If AGI is $ 5,000 a year, your maximum contribution to your IRA is $5,000.

You can contribute as much as you want to your IRA. However, you cannot deduct any part of the contribution above the “qualified” limit from your federal taxable income. Additionally, you pay Federal taxes on any gain on the excess contribution. An accounting nightmare. Many investment IRA accounts will not let you go over the "qualified" limit or force you to withdraw excess contribution at the end-of-the-year. Instead, put any amount over the allowed IRA contribution into a "taxable" account. As far as I know, investment firms that offer IRA accounts also offer "taxable" accounts.

If, at age 30, you make an IRA contribution of $4,800 per year to a market index for 35 years. At the start of your retirement, at age 65, your yearly contributions enjoyed an average yield of 8.5% per year, you will have an IRA of $925,000.

Compare the taxable gain example, which after 35 years of the same investment, resulted in a worth of $580,000. An IRA almost doubled the worth of your investment.

An online calculator as an alternative to Equation 1. is found here.

Let-er-ride Example 3: IRA Monthly Contribution

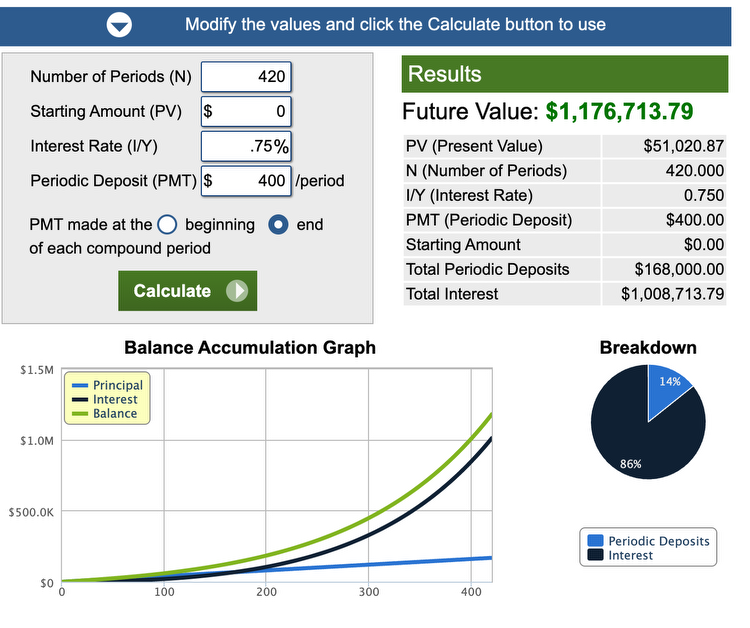

You can make (total-annual-contribution/12) per month, which divides your annual contribution of $4,800 up into twelve monthly contributions of $400. Because you make a monthly contribution, the stock market's 9% annual growth, or 9%/12 = 0.75% monthly growth, occurs at the end of each month instead of at the end of the year.

In this scenario, you will have an IRA worth $1,177,000 in 35 years of contributing $400 per month. That is $252,000 or about 25% more with a monthly contribution than a yearly contribution of the same total yearly contribution.

Note: There are service firms that if you pay them your monthly mortgage payment, they will make bi-monthly payments to your mortgage holder, and you will save a lot of money. You can do this yourself. Split your monthly payment into two payments, one at mid-month and one at the end of the month. Your mortgage holder allows this, you avoid the service firm fee, and you leverage Equation 1. to save you a lot of money over the 30-year term of your mortgage.

Example 4: 401k Contribution with Company Matching

A 401(k) is a retirement investing plan.Contributions are automatically withdrawn from employee paychecks and invested in funds of the employee's choosing (from a limited list of available offerings).

If you are working at a company with a 401k plan, you can put up to $20,500 in your 401(k) in 2022. The 50 years-and-older staff is allowed an extra $6,500 for a total of $27,000.

Some (great) employers match your contributions. The company's contribution does not count toward your 401k limits.

Note: Al the 401k plans, that I am aware of, offer investment choices from a shortlist of available offerings. Unfortunately, the list of funds that are offered has fairly high management fees and the majority of them show a yield less than the "dartboard" S&P 500 index. The rather radical solution is to quit (or get fired) and roll your 401k into an IRA, where you are free to choose your investment vehicles. If you have a good friend higher up in the firm, and you like working there, get hired back after you are done with the rollover to your IRA.

For example, you are an employee who asks that $1,000 per month be taken out of your paycheck, before taxes, and used as your 401k contribution. Because you are a highly valued employee, the company matches with $500 a month to your 401k contribution. The total contribution of $1,500 per month is put into a "mid-cap" fund that grows on an average of 6% after management fees. After 30 years, your 401k is worth $2,137,000.

In a different scenario, you quit after a year. You roll your 401k into an IRA. You do well as a consultant, which enables you to put $1,000 into the IRA fund, which allows you to choose the EFT VGT, which yields 9% per year. After 30 years, your IRA is $2,902,000.

Choice of investment vehicle results in quite a difference even with company matching of 50%.

In this scenario, the company would have to 401k match at 100%.

Note: Again, an exchange-traded fund (ETF) is a type of pooled investment security. ETFs can be purchased or sold on a stock exchange exactly like a regular stock. The EFTs I like to track a market exchange, such as the NYEX stock exchange (New York stock EXchange) or the NASDAQ (National Association of Securities Dealers Automated Quotations) stock exchange , or track a sector, such as technology, or a category, such as "mid-cap"(short for middle capitalization companies).

Withdrawals in Retirement - Can't use Equation 1

Remember, Equation 1. to be correct requires the yield to be steady every year.

However, if you make only contributions and no withdrawals AND use an average yield over ten years or more, then Equation 1. results in a good approximation of the future value of your stream of investments — if the market continues to behave as it has for the 120 years.

The most probable action that makes Equation 1 suspect is withdrawals. Investment firms do not loan you money to get over a less than zero holding value.

Maybe an example puts more meaning in the above statement. You put in $100,000 in a stock market index with an average yield of 10% per year. You withdraw each year $10,000 — the amount you expect to gain each year. Using Equation 1, your $100,000 investment lasts forever at the end of each year, and you realize a principal of $100,000 every year.

However, in reality, the yields vary over 15 years as the sequence:

where -45% is the yield (loss) the first year, 10% yield the subsequent, 65% yield the third year, and so on to the fifteenth year. Notice that the average yield is 10% over the fifteen years in this scenario.

You can't have a negative balance in your account, so you can only withdraw $8,954 at the end of the fourteenth year, and you have a principal of $0.

You are out of money.

Equation 1 does not work where your monthly withdrawal is bigger than your monthly deposit.

Equation 1 is still valid as long as your monthly withdrawal is smaller than your monthly deposit because you effectively make a smaller contribution.

Use Equation 1 for your "let-er-ride"investment strategy. For our retirement, we need something else.

Retirement - Use Simulation

As was shown above, we can't use Equation 1 for the withdrawals we accomplish over retirement. We raise the stakes by requiring that we don't zero our principal and run out of money during retirement.

We will use one of the best calculators I know about for our simulation. I avoid using and showing you code for a simulation calculator for a huge added benefit.

Note: Many years ago, I wrote a Monte-Carlo simulator that used one of the NASDAQ indexes implemented in the computer language FORTRAN. I find that Vanguard's implementation to have more inputs and their choice of random selection among several benchmark indexes is perhaps better. I can not prove Vanguard's simulator is better (or worse) than my implementation for future predictions. However, I back tested it on historical data on yields resulting from a 20-year average trendline of various indexes' history. I found Vanguard's 95% confidence limit to be relatively closer to the average yield of five different indexes by approximately 11%. Any (correct) implemetnation may differ mostly by the selected benchmark yields. I consider 11% in the noise. The significant bonus for me is that I no longer have to port, after I buy the compiler, my crusty FORTRAN code.

Vanguard, who offers up the calculator, does an excellent job of explaining how it works.

There is a lot you can do with this calculator. I intend to write an article explaining what this calculator can do and what it means in more detail than here.

If you are interested, you can read about the simulation that the Vanguard retirement calculator uses by clicking on "What is Monte Carlo Simulation?" located below the charting of results. You can dig deeper into Monte Carlo simulation for finance at Investopedia's "Monte Carlo Simulation."

In a given year, yields vary. Because we are calculating the FUTURE value of our investment, we require a range of yield values to feed our simulation.

For stock market returns, Vanguard uses the Standard & Poor's 500 Index (S&P 500) from 1926 to 1970, the Dow Jones Wilshire 5000 Index from 1971 through April 2005, and the MSCI US Broad Market Index after that.

Using S&P 500 for our simulation is a good general solution for choosing yields. Why? Warren Buffet says so:

“I recommend the S&P 500 index fund and have for a long long time to people.” Warren Buffet May 3, 2021

If you would like to know more about Warren Buffet, click here.

Example 5: Simulate Retirement Capital of $500,000.

I put my trust in stocks when invested for twenty years or longer.

I will put my entire savings of $500,000 in stock indexes and withdraw $30,000 a year or $2,500 a month.

For 30 years of investing and spending, how many simulation runs out of 100,000 runs are there with positive savings? Figure 3. shows that 65,000 simulation runs resulted in positive savings.

Even more probable, Figure 3. shows 87,000 out of 100,000, or 87%, of simulation runs, result in positive savings outcomes for withdrawals of $30,000 over fifteen years.

Figure 3. shows the range from one year to fifty years of withdrawal of $30,00 a year from your starting retirement capital of $500,000.

As shown in Figure 2, play with Vanguard's retirement calculator settings for your different retirement scenarios.

Use Equation 1 and the Let-er-ride investment strategy.

Put as much as you can in an IRA and put any of the contribution leftovers in your company's 401k.

If your company "matches" 100% or better your 401k contribution, the exception is that. Since the stock market has traditionally yielded 9%, reverse the above guidance. Put in as much as is matched in the 401k and put any of the contribution leftovers in your IRA.

Take the ending fund amount from your Let-er-ride investment strategy and use it in the Vanguard simulation calculator as your starting capital for retirement. Set your retirement length to at least fifty years to be safe. If you retire at 65, you "finally retire" at 115. When you " finally retire, " at 115 years or younger, when you "finally retire," leave some capital in your estate. Leaving funds in your estate assures that somebody(ies) are virtually invested in your "finally retirement."

In the next article, I delve into a strategy you can use when you are sure the market will go down more than 10% or go up more than 10 %. I call it the "buy low, never sell" strategy.

"Buy low" is timing the market.

In this case, we have the capital to jump-start our investment. We will time the market ONCE, and then we will use the "Let-er-ride" investment strategy.