Deposit refunds by casinos, online gaming sites taxable

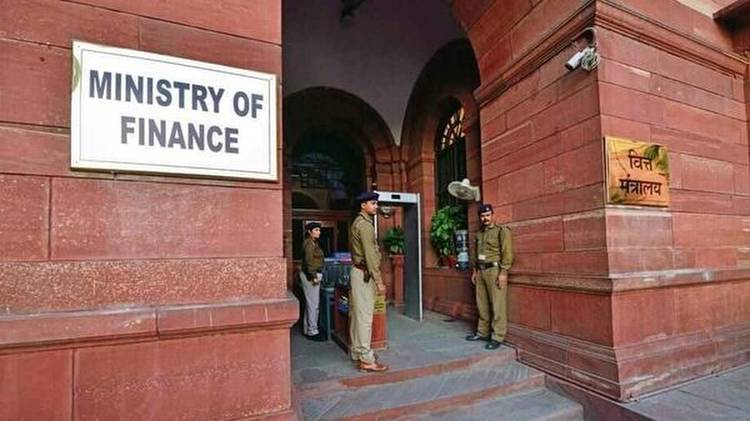

The finance ministry on Wednesday notified the way deposits made to online gaming platforms and casinos will be treated for tax purposes, clarifying that refunds made to the player will not get any relief on tax.

The changes are introduced by amending CGST rules 2017, by way of CGST (Third Amendment) Rules, 2023, which are effective from a date to be announced by the government.

The taxable sales value of online gaming service will be the total amount deposited with the platform. Any amount returned or refunded by the supplier to the player for any reason, shall not be deductible from the value of supply of online money gaming, the order said. That includes instances where the player is not using the amount deposited with the supplier.

In the case of casinos too, any amount returned or refunded by the casino to the player on return of token, coins, chips, or tickets, or otherwise, shall not be deductible from the value of the supply of actionable claims in casino, said the order.

Saurabh Agarwal, Tax Partner at EY said the amendments give effect to the recommendations made in the 51st GST council meeting relating to the valuation methodology to be adopted for discharging GST obligation by the gaming industry. "This shall effectively settle the ambiguity and uncertainty around this issue. However, the aspect of whether mere deposit of money in a wallet qualifies as a supply is unclear, and may possibly be challenged by industry," said Agarwal.

According to the new valuation norms, full tax rate of 28% would be applied to the total amount paid to online gambling companies and casinos, with no relief for the taxpayer in the event of a refund or return of money, explained Rajat Mohan, Senior Partner at AMRG & Associates. (ends)

Catch all the , , Events and Updates on Live Mint.Download The to get Daily Market Updates.