Bally’s Medinah Temple temporary casino landlord Albert Friedman will hit $20 million jackpot under 4-year lease

Chicago’s first casino has yet to open to the public, but someone already has hit a jackpot topping $20 million.

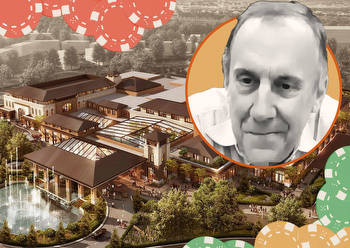

It’s Albert M. Friedman, the clout-heavy developer whose tenants have included three mayors — Brandon Johnson, Lori Lightfoot and Rahm Emanuel.

Friedman owns the historic but long-vacant Medinah Temple building about a mile north of City Hall that he’s leasing to Bally’s for a temporary casino until it builds a planned gambling emporium at the riverfront site of the Chicago Tribune’s printing plant.

Bally’s has to pay Friedman more than $16.5 million in rent plus a management fee of $330,000, under the terms of its four-year lease, obtained by the Chicago Sun-Times.

Bally’s also must pay Medinah Temple’s Cook County property taxes — a bill that has topped $1.1 million a year.

If Bally’s decides to extend the lease for another two years, Friedman would get an additional $9.6 million in rent and management fees, and the casino operator would keep paying the property taxes.

The 80-page lease spells out how much money Friedman will collect from Bally’s.

It doesn’t explain Bally’s switching the location of the temporary gambling hall to the vacant building that long hosted the Shrine Circus before Friedman converted it into a furniture store for Bloomingdale’s with financing from City Hall. Bloomingdale’s moved out in October 2020, during the first year of the COVID-19 pandemic.

Bally’s and Friedman didn’t return messages seeking comment.

For more than five months after Bally’s announced its casino bid in 2021, leaders of the publicly traded corporation said in public pitches that they wanted to build the temporary casino on the Tribune property, just north of the printing facility where the permanent casino is planned.

Those plans changed only days before Lightfoot chose Bally’s to operate the long-sought Chicago casino over competing bids from Hard Rock International and Rivers Casino chairman Neil Bluhm in May 2022.

Bally’s chairman Soo Kim said at the time that, despite his preference for putting the temporary casino at the Tribune site, city officials told him that plans to replace the nearby Chicago Avenue bridge would complicate doing that and urged him to go with Medinah Temple instead. Kim said the switch came a few days before the Bally’s selection became official.

Representatives of Lightfoot have said she had “no involvement” in the Medinah Temple selection.

But Samir Mayekar, who was her deputy mayor, exchanged emails with Friedman regarding Medinah Temple a few months before Lightfoot picked Bally’s, the Sun-Times has learned.

A month after that email exchange, Lightfoot’s administration narrowed the field of five competing casino bids to three with an evaluation report that revealed each developer was asked to consider using a hotel or vacant property for a temporary site “to help support ongoing pandemic recovery efforts.”

The city floated Medinah Temple and the Sheraton Grand Chicago as alternative sites because of their “proximity to major transit and retail/hospitality corridors as well as their ability to assist in the city’s post-COVID revitalization.”

The 111-year-old Medinah Temple, long the headquarters of the Shriners fraternal organization, has since been outfitted with about 750 slot machines and 50 table games. Bally’s is expected to operate there for three years while its permanent $1.7 billion River West casino is built.

Bally’s held two practice gaming sessions in recent days at Medinah Temple under the eyes of state gambling regulators — the company’s final test before Marcus Fruchter, the Illinois Gaming Board’s administrator, deals them a temporary operating permit.

As long as the practice operation passed muster — and Bally’s already runs another casino in far western Illinois, which is among more than a dozen it operates nationwide — Medinah Temple appears poised to open for betting business within days.

Bally’s executives have said they expect to turn a monthly profit at Medinah of $3.5 million to $5 million through the end of this year and up to $60 million with a full year of gambling in 2024.

City officials are banking on eventually getting as much as $55 million in yearly tax revenue from the temporary casino and nearly $200 million a year from the permanent casino, which is expected to open in 2026. That 3,400-slot facility is projected to take in more than $800 million a year by 2028.

Medinah Temple is among many historic River North buildings owned and restored by Friedman and his Friedman Properties. Referred to by some as the mayor of River North, Friedman says on his website that the company has redeveloped 12 city blocks. Several of those buildings were rehabilitated with government funding.

His tenants have included some of Chicago’s best-known restaurants, including Frontera Grill, as well as campaign offices for Johnson, Lightfoot and Emanuel. Lightfoot’s campaign and political action committee spent more than $196,000 leasing office space from Friedman between 2019 and 2023, according to campaign-finance records.

After Johnson was elected mayor, his transition team worked out of Friedman’s Reid Murdoch Center along the Chicago River.

Over the past few decades, Friedman, 74, and his company have given hundreds of thousands of dollars to the political campaign funds for government officials including former Mayor Richard M. Daley and Cook County Board President Toni Preckwinkle.

Like most commercial landowners, Friedman frequently seeks to cut his property tax bills and often has hired the law firm of former Illinois House Speaker Michael J. Madigan to challenge the Cook County assessor’s office’s estimation of how much his buildings are worth.

Madigan’s law firm filed the most recent appeal on Medinah, attaching a copy of Friedman’s lease with Bally’s to convince Assessor Fritz Kaegi to slash his estimation of the value of the building on the grounds that it was vacant until Dec. 1, 2022, when the casino lease began.

The lease shows that Bally’s is actually subletting Medinah Temple under the lease Friedman signed with Bloomingdale’s in April 2001.

Under the four-year lease, Bally’s is to pay Friedman a total of $16,593,891 in rent, and the company has two, one-year options that could extend the lease until Feb. 3, 2029. If Bally’s exercises those options, Friedman will have collected more than $26 million in rent.

Bally’s is responsible for the utilities, insurance, security and exterior landscaping, but it also has to pay Freidman a management fee equal to 2% of the rent.

Those management fees will cost Bally’s $331,879 over the course of the four-year lease and another $189,867 if the casino ends up staying for six years by exercising its rental options. State gambling law allows the company to operate from the temporary facility for up to three years.

The lease says that, as the owner of Medinah Temple, Friedman “shall use commercially reasonable efforts to reduce the real estate taxes in each year.” But Bally’s will have to pay the annual real estate taxes.

Since Bloomingdale’s left Medinah three years ago, Friedman has been able to cut his property taxes by retaining Madigan’s law firm to convince Kaegi to repeatedly lower his assessed value of the property — resulting in lower taxes — because it was vacant.

Last year, Kaegi sent Friedman a notice that Medinah Temple’s value had jumped to $27.2 million — a 20% increase that would have caused a significant hike in this year’s yet-to-be-calculated real estate tax bill.

Madigan’s firm appealed, arguing that the building’s value had fallen to $18.8 million because it was vacant nearly all last year — until Bally’s began paying rent last December.

Kaegi eventually lowered his assessment, setting the building’s value at $23.4 million, a figure later affirmed by the Cook County Board of Review, which rejected Madigan’s efforts to further lower the assessment.

So Medinah Temple’s real estate taxes will likely top last year’s bill of $1,138,660, though the exact figure won’t be known for several weeks.

Whatever this year’s property tax bill ends up coming to, 96% of the money will go to the Ohio/Wabash Tax Increment Financing District that the Daley administration created in 2000 to repay $20 million in loans City Hall arranged so Friedman could rehabilitate Medinah Temple for Bloomingdale’s.

According to a city official, those loans should be repaid by the end of 2024, when the TIF district expires. Neither Bally’s nor Friedman got any TIF money to build the casino, the official said.