LRWC bets on online bingo to reverse pandemic losses

Listed gaming firm Leisure and Resorts World Corp. (LRWC) hopes to recover from recent losses to reach prepandemic revenues by 2023 or late this year, aided by the explosive growth of its newly established online bingo business.

The online betting platform, called Bingo Plus, allows users to place wagers as low as P5 to win jackpot prizes worth millions of pesos.

Through subsidiary AB Leisure Exponent Inc., LRWC is the country’s only group to obtain a license from the state-run Philippine Amusement and Gaming Corp. to operate “online traditional bingo.”

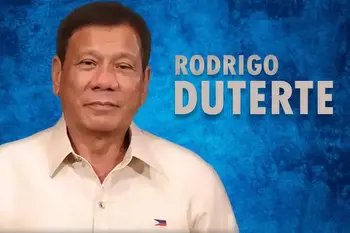

Tsui Kin Ming, president of LRWC, a company owned by ports and education tycoon Eusebio “Yosi” Tanco and businessman and Bacolod Mayor-elect Alfredo “Albee” Benitez, said online bingo could be a future major revenue stream.

“We expect revenues to get back to somewhere close to the prepandemic level maybe early next year or end of this year,” Tsui said in an interview during a media event on Friday.

LRWC’s revenues at the parent company level reached P610 million in 2019.

It recorded no revenues in 2020 as its businesses suffered from severe restrictions amid the COVID-19 lockdowns. LRWC lost about P410 million that year, reversing profits of P97.52 million in 2019.

Jasper Vicencio, president of AB Leisure, said they planned to rapidly expand online bingo as activity in its bingo halls had yet to fully recover.

From a few thousand online bingo players when the business was launched in January this year, the platform is now handling over 40,000 players per day, according to Vicencio.

“Because it’s electronic, a lot of players are playing also. So, you can win a game in about five minutes. It’s very fast. We have 200 games in a day,” he said during the same event.

LRWC said in its financial report covering the first quarter of 2022 that online bingo revenues surged from P3.8 million in January to P30.65 million in March—a growth of over 700 percent in three months.

In an attached report in LRWC’s 2021 annual report, independent auditor SyCip Gorres Velayo & Co. raised red flags on the company’s losses and negative operating cash flow.

Last March, LRWC said it would raise P2.1 billion via the direct sale of 1.27 billion new shares at P1.65 each to seven companies, including firms controlled by Tanco and Benitez. The companies have until Aug. 9 this year to pay for the shares. INQ

Read Next

INQUIRER PLUS to get access to The Philippine Daily Inquirer & other 70+ titles, share up to 5 gadgets, listen to the news, download as early as 4am & share articles on social media. Call 896 6000.