Play Synergy announces acquisition of Aruze Gaming America's slot operations

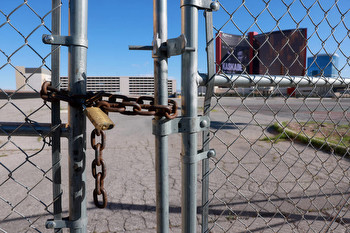

Play Synergy announced Monday it is set to acquire Aruze Gaming America's slot operations, which includes its land-based assets and online gaming offering, for an undisclosed amount. The news comes days after the slot machines and electronic table games developer said it was planning to shut down its Las Vegas headquarters nextmonth, resulting in the layoff of around 100 employees.

Through the deal, Play Synergy will take charge of Aruze's land-based and online slots operations, alongside related sales and support services attached. The company said it is “confident” the deal will close within the next 30 days, depending on regulatory and court approvals.

“The addition of these assets and associated personnel will significantly enhance Play Synergy’s presence in the gaming industry,” the Empire Technological Group-owned supplier explained. It further promised that its team is committed to "a smooth transition" amid the purchase.

Frank Feng, President of Play Synergy, stated: “Aruze, Play Synergy, and all other stakeholders in the process have worked exceptionally well together to provide the vast majority of Aruze team members with new employment opportunities. This along with interest from others in the industry has had the result of minimizing the disruption to those impacted and their families.”

Aruze's tough year

The newly revealed Play Synergy takeover follows reports of Aruze's decision to, first confirmed by Las Vegas Review-Journal. The move came approximately six months after the company filed for Chapter 11 bankruptcy protection. At the time, Aruze stated that the filing was necessary to restructure financially due to "external factors outside (their) control."

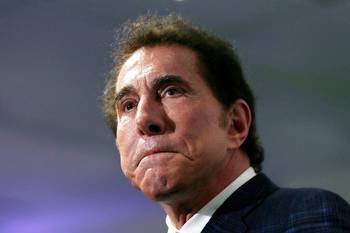

One of the factors contributing to the bankruptcy filing was a garnishment judgment of$27.4 million against Aruze, resulting from a separate legal judgment against the company's sole shareholder, Kazuo Okada, a Japanese businessman and former investor in Wynn Resorts.

The judgment stemmed from a court ruling that Okada failed to pay a $50 million "success fee" to the law firmBartlit Beck LLP, which represented him in a lawsuit against former Wynn Resorts boss Steve Wynn. The lawsuit was eventually settled for $2.6 billion with Universal Entertainment Corp., founded by Okada.

Bankruptcy court filings revealed thatAruze also has other secured creditors, including bank loans totaling approximately $20.8 million. The largest unsecured claim listed during the bankruptcy filing was the garnishment judgment, with several other claims of $1.6 million or less.