New York, Maryland Seen As Likeliest '24 Online Casino Adopters

While legal online casino gaming has brought far more tax revenue to the six states where it’s operational than sports betting, the former discipline lags far behind the latter in terms of nationwide expansion. Fairly or not, fears over cannibalization of the retail casino product persist, as do concerns over the potential for a spike in problem gambling.

Could 2024 finally be the year when mobile casino apps gain serious momentum? Don’t bet on it, although that’s not to say progress won’t be made. As Howard Glaser, head of government affairs at Light & Wonder, observed at the annual Global Gaming Expo (G2E) this past October, the post-COVID spigot of direct payments to states is in the process of getting shut off, which could compel some legislatures to “pull iGaming off the shelf” to prevent budget shortfalls.

At G2E, Glaser said that “more than half of U.S. states with land-based gaming will have iGaming as well” within the next five to seven years, and he’s among three industry insiders — the others being Entain Foundation trustees Martin Lycka and Bill Pascrell III — who shared their thoughts on what lies ahead for the sector in 2024 and beyond.

US Bets: What states do you think will take significant steps toward legalizing iCasino in 2024 and are there any you feel may pass legislation green-lighting this form of gaming by the end of 2024?

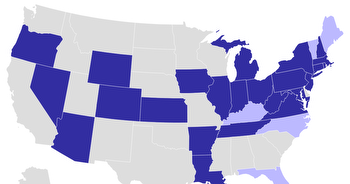

Martin Lycka:New York, Maryland, and Illinois, all of which have legal sports betting and have already displayed a degree of legislative movement on iCasino, are likely candidates for more progress in 2024.

Bill Pascrell III:Sen. Addabbo’s leadership on iCasino in New York has been incredible, and his efforts will certainly yield movement in 2024. The benefits to New York are clear, and iCasino will be legalized in the Empire State — it’s just a question of when.

Howard Glaser: The landscape is definitely challenging. Some states that were anticipating to be moving have some internal issues that are not going to be favorable to the adoption for iGaming, such as Indiana and Iowa. The best prospects for movement in 2024 are New York, Maryland, and Louisiana. New York and Maryland both have budget gaps; in Louisiana, you have a new governor and an industry that’s very strong. Does that mean they’ll get over the finish line? Not necessarily. There are headwinds that generally are facing iGaming and some that are specific to those states.

US Bets: What are some of the states — as Howard mentioned, Indiana comes to mind — that were clubhouse favorites to pass iCasino legislation in years past but didn’t, and what sort of headwinds have prevented those states from crossing the finish line?

Lycka: Indiana is a prime example, partly due to the state’s failure to pass proposed legislation three years in a row. Among the most notable headwinds facing these states are misconceptions about iCasino, most notably that it will hurt brick-and-mortar casinos (it doesn’t), that the black market for iCasino isn’t a threat to be concerned by (it is), and that iCasino is uniquely addictive and dangerous relative to sports betting (it isn’t).

Pascrell: New York was disappointing but not surprising. The iCasino industry still faces fierce opposition, largely driven by fears of how iCasino will impact bettors and brick-and-mortar casino operators. With each successive state that passes and reaps the benefits of iCasino, and as we continue to educate lawmakers and casino operators on the topic, I’m very confident that we’ll see progress — not just in New York but throughout the country.

US Bets: A hotly contested argument is that iCasino cuts into brick-and-mortar revenue, despite credible data showing that not to be the case. What will it take for the industry to convince lawmakers and critics that the two can coexist quite beneficially?

Glaser: There remains a concern about the impact on land-based gaming. This is largely not supported by the evidence, but there’s certainly some volatility in the data. All of these states have made significant investments in brick-and-mortar casinos. While going online doesn’t have a negative impact in the casino sector, people have seen it in other fields — when an industry goes online, the retail sector suffers.

Go to a shopping mall over the holidays. The lines aren’t there because people can shop online. But you need to show lawmakers that that’s not the case with online casinos. It increases the customer base. It’s a winning combination when you have a digital channel. If you can imagine a scenario where there’s not digital gaming in five to seven years, there’s no question casinos will suffer. There’s just too much digital entertainment out there.

We have very good proof points from the states that are mature in this area, such as New Jersey and Pennsylvania. Both of those states have had steady growth since the introduction of iGaming. That’s a story that we need to get out. It’s a specific concern in New York and Maryland, which are union states.

Pascrell: The statistical argument for iCasino doesn’t tell the full story. When educating lawmakers and critics on iCasino, we have to present a vision for what a legal, regulated iCasino state looks like and why it benefits everyone involved. That vision has to outline the operators’ role in protecting customers, the demographic shifts that can allow for prosperous brick-and-mortar and iCasino operators, and the ability for new iCasino laws to benefit taxpayers, industry, and bettors alike.

Lycka: The data from legal iCasino states can seem incredulous to critics who can’t understand how enabling casino gambling on mobile phones won’t deter people from visiting brick-and-mortar casinos. But the reason is simple: People visit casinos for the experience, which can’t be replicated on a mobile device. In states with legal, regulated iCasino, you don’t see reduced foot traffic in casinos — not only because those who visit casinos will continue to want to do so, but because iCasino increases the overall popularity of casino betting, which benefits the existing operators.

US Bets: What about the argument that iCasino is a more addictive form of online gambling than sports betting? Whether that’s actually the case or not, how do you blunt such an argument?

Pascrell: Unlike brick-and-mortar casino gambling, iCasino offers a broad range of safeguards and player protection tools to keep bettors safe. By legalizing iCasino, we can better educate and protect bettors than if we limit casino gambling to brick-and-mortar locations.

Lycka: There’s no evidence to suggest that iCasino has a higher rate of addictive behavior than other forms of gambling, like sports betting. I suspect much of the concern over iCasino is driven by the dramatic scenes portrayed in movies of down-on-their-luck gamblers in smoke-filled casinos — and it’s simply not in line with reality.

Glaser: One of the strongest tools that we have is to show, not just tell, what the protections are that are available for consumers. The iCasino and sports betting regimens require users to register, so you have a much greater chance of providing protection in a much easier way than you do with a brick-and-mortar casino. You walk into a brick-and-mortar casino, you’re basically anonymous. When you go online, there’s a different level of protection. And you can’t ignore that online gaming is accessible in all the states that haven’t legalized iGaming. What’s the argument for leaving an illegal market rampantly exploiting consumers in place?

US Bets: While states like Michigan and New York feature casino industries that offer a blend of tribal and commercial interests, tribal control is more monopolistic in Western states like California. What do you think the ideal process for crafting an Indian-led iCasino market might be and how lucrative might it be for various tribes?

Glaser: In Florida, if the Seminoles had their way, there certainly would be iGaming. Some more of the reluctance is in Western states where you have exclusive tribal gaming and commercial entities want to enter the casino market. Obviously, that played out in California last year and is playing out again. It was extraordinarily ludicrous for some of the casino industry to try to enter into a sovereign market. That conflict has slowed the process down.

When the tribes are ready and have a clear path, it will be one of the most profitable enterprises for Indian tribes since land-based gaming. They just want to do it right. More likely, we’ll see the commercial states go first.

Lycka: An Indian-led iCasino market, if properly implemented, has tremendous potential to be lucrative for the tribes. So long as the market is well-regulated, transparent, and appeals to a broad audience, the tribes can expect a robust revenue source that provides well-deserved support to their communities.

Pascrell: Collaboration is at the heart of any Indian-led gaming market, iCasino or otherwise. We have to emphasize the importance of tribal sovereignty, create a regulatory framework that involves tribal gaming commissions and regulators, follow a process that allows for negotiation and compromise between tribes and states, and develop fair and transparent revenue-sharing agreements. Any measure to implement an Indian-driven iCasino market without collaboration will fail.