How the New Tax Impacts Gambling in India

India has quite a developed online gambling market, and many offshore operators exploit it. The world’s second-most populated country is a great playground for all online casinos, and they widely started accepting gamblers from India.

On the other hand, the government has also spotted opportunities for generating more income. Therefore, a group of ministers has been actively working on introducing a new tax policy on gambling. However, that plan has triggered many controversies, and it could have a significant impact on the Indian gambling market.

In this article, we will analyze the potential impact of new tax regulations on the best online casinos in India.

How do the best online casinos prepare for the upcoming tax increase

The group of ministers came out with the proposal to push the gambling tax from the current 18% to 28%, which is a significant increase. It rattled the cages of the gambling industry in India, and the gambling operators have expressed their concerns about this proposal. They think that these changes will provide a massive hit to the gambling industry and introduce many uncertainties in the future.

Another major difference that the new model brings is the suggested tax scheme. Currently, gambling companies pay an 18% tax on their net profits. However, with the new model, they would have to pay a 28% revenue tax. Even the best online casinos analyzed by casino experts from scams.info would feel the negative consequences of this new model. Therefore, all gambling entities in the country point out the harmful impact of the increased taxation policy on the entire gambling industry. The best online casinos still hope that the situation will change for the better.

However, gambling companies need to be ready if the new taxation policy gets officially accepted. They can apply different strategies, from leaving the Indian market to altering their services to remain in profit. Whatever approach they take, it won’t bring any good for players.

Details of the new taxation model

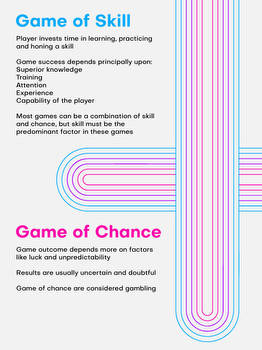

Taking a deeper look into the proposed tax policy reveals that it is quite heavy-handed. As we already mentioned, it includes paying a 28% tax on revenue, and gambling companies believe this might have a devastating impact on the industry. Moreover, it would affect a wide range of gambling activities, like sports betting, horse racing, casino gaming, poker, bingo, fantasy sports, and daily fantasy. Therefore, the major gambling forms will be impacted. Besides that, the new taxation model does not make the difference between games of skill and games of chance. They are considered at the same level, and players and operators share the same opinion that this approach is unfair.

These changes are quite different from policies we can see in other countries. As a consequence, gambling operators in India will have to pay taxes several times more than they used to. Since gambling companies work on specific margins, it means that many businesses might become unprofitable, and the industry will have to deal with heavy disturbances.

How would the new taxation model work in practice?

The main difference, besides the tax rate, is the way the new mode will work. Gambling companies, including online casinos, will have to pay taxes on their revenue and not on net profits as they currently do. There are several approaches under the proposal, and one of them is to tax the purchase of chips. However, that solution has many flaws. For example, you can buy drinks or food with chips in land-based casinos. Therefore, the non-gambling service may fall under gambling taxes, which is contradictory and unjust.

Another problem occurs in games like poker when there is an exchange of money involved. The games of skill and games of luck fall under the same category, which is another point where this revenue-based model suffers a lot of criticism. There are still a lot of discussions to take care of, and hopefully, the authorities will find the right approach to address them all.

The future of the gambling market in India with the new model

These taxation changes will undoubtedly hit the Indian gambling market. Although the implementation is currently on pause, the new law is likely to be accepted in the near future. And if the approach remains unchanged, the new tax model will introduce a lot of dissatisfaction among gambling operators. Consequently, it will reflect on players as well.

Therefore, gambling companies operating in the Indian market need to be ready for the shockwave. It is questionable whether many operators will manage to avoid losses and eventually fail for bankruptcy. The Indian gambling market heads to challenging times, and we wouldn’t be surprised if some reputable operators just leave it due to a heavy tax policy. Domestic online casinos might be pushed out by international operators, who already exploit the Indian gambling market. These changes might sink many companies, and the new ones who would like to enter the market will probably think twice before making such a move.

Eventually, players will feel the negative impacts of the new taxation model, although they are not directly hit by the proposed rules. Online casinos will increase the margins, while sportsbooks, for example, will decrease the odds of remaining afloat. Generally, gambling companies will increase the house edge, which provides fewer opportunities for players to make profits. In the case of online casinos, games with a low Return to Player will dominate their portfolios. Overall, these changes might cause many setbacks in the Indian gambling market, which has experienced steady growth so far.

Conclusion

Having a regulated gambling industry brought many benefits to other countries. Gambling taxes are inevitable, and governments can enjoy many benefits from taxing proceeds and investing them in other sectors. However, these drastic measures can only disrupt the growing industry. These changes shouldn’t bring benefits in the long term, as the government should preserve a healthy gambling market to enjoy the taxation fruits from its success. Nevertheless, we will keep tracking developments around this hot topic and investigate the consequences further.