Gambling Commission figures show land-based gambling surge

The Gambling Commission’s Gambling Industry Statistics show total gross gambling yield (GGY) grew 6.8% year-on-year to £15.1bn ($19.0bn/€17.5bn) for the 12 months from April 2022 to March 2023. This figure, accrued from all licensed remote and land-based gambling operators, was also up 6.6% on the last pre-lockdown period to March 2020.

GGY was up slightly more compared to the prior period when removing reported lotteries from the figures. The £10.9bn total was up 9.3% compared to 2021-22 and 7.6% compared to 2019-20.

Remote gambling remained the biggest revenue generator for the sector, with £6.5bn taken by the remote casino, betting and bingo sector. This was up by a moderate 2.8% year-on-year and by 13.3% compared to pre-lockdown figures. The number of new account registrations with RCBB operators was up 10.6% to 36.4 million.

Online casino games dominate the sector, generating £4.0bn in GGY. Some £3.2bn of this was from slots games. GGY for remote betting totalled £2.3bn, led by football (£1.1bn) and horse betting (£733.5m). GGY for remote bingo totalled £173.6m.

Growth driven by land-based gambling

Land-based gambling saw its share of the total GGY grow to 41% from 35% last year.

Total GGY from arcades, betting, bingo and casino reached £4.5bn, which was up 20.6% year-on-year. Land-based gambling revenue has now returned to pre-pandemic levels (up by 0.2%) after Covid-related rules led to closures and restrictions during 2020 and into 2021.

Gaming machine GGY grew by 23% to £2.4bn. While eye-catching, machines remain at around 50% of land-based GGY, just as they did last year.

Notably, this figure was up 17.9% on the last pre-lockdown period, despite overall land-based GGY being flat compared to 2019-20.

The surge in takings from land-based premises comes despite continued closures, with 186 fewer by the end of March 2023.

Total numbers of betting premises fell for the ninth consecutive reporting period to 5,995, which was down 2.2% year-on-year. That’s also a decrease of 1,386 (18.1%) on the pre-lockdown period.

Non-remote betting GGY was £2.5bn, a 15.4% increase on the previous period and a 2.5% increase on the latest pre-lockdown period.

The non-remote casino sector saw a £118.6m increase of 17.2% in GGY to £810.4m. This is a decrease of £207.2m, or 20.4%, in GGY from the last pre-lockdown period.

The biggest area of growth is non-remote arcades, which generated GGY of £572.2m. This is up 38.9% year-on-year and by 32.8% compared to pre-pandemic figures. GGY is £533.3m (up 40.8%) for adult gaming centres and £38.8m (up 16.3%) for family entertainment centres for this latest reporting period.

National Lottery ticket sales totalled £8.2bn, which was up 1.1 on 2021-22. Some £4.7bn was returned as prizes. Large society lotteries ticket sales totalled £943.9m, which was up 2.6%.

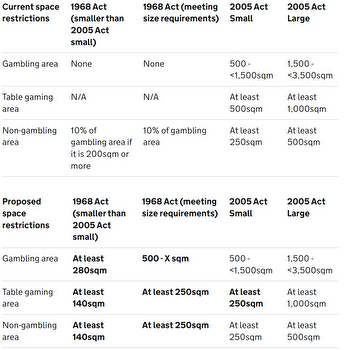

Second Gambling Act review consultation launched

The Gambling Industry Statistics study has been released in the same week the GB Gambling Commission launched its second set of consultations on proposals from the Gambling Act review white paper.

The second set of consultations will run for 12 weeks, implying a deadline during February 2024.

This second round will focus on five topics, including socially responsible incentives, specifically bonuses and free bets. Customer-specific tools, which would give customers greater control of their gambling habits, will also be discussed.

“The white paper set out that a top government priority is ensuring that gambling happens safely,” said Tim Miller, executive director of research and policy at the Commission.

“We share this commitment and today’s consultations propose how we can deliver on it. We need as many people as possible to have their say on any potential changes to the rules operators must follow.”

Earlier this month, the Commission released new data that suggests one in 40 Britons is a problem gambler. The figures were released following an overhaul of its data gathering processes.