Q&A: land-based gambling in United Kingdom

The following types of land-based gambling are permitted where operators hold the appropriate licences issued by the Gambling Commission and their local licensing authority:casinos, arcades, adult gaming centres (AGCs) and family entertainment centres, betting and bingo.

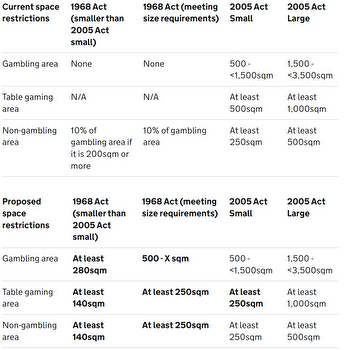

Operators proposing to provide land-based gambling must hold an operating licence from the Commission and a premises licence. The licence is for the type of gambling for which the premises is to be used. There are three categories of casino licence: small, large and converted. Card rooms and poker rooms must also hold a casino premises license. The majority of the converted licences have been awarded. Eight small and eight large casino licences were made available under the Gambling Act 2005. They were allocated to 16 licensing authority areas. Each licence was subject to a public competition.

An operating licence from the Commission and a premises licence for the area in which the premises are located.

The key positions in a gambling operator's management are: strategy and delivery of gambling operations, financial planning, control and budgeting, marketing and commercial development, regulatory compliance, IT provisions and security, and money laundering reporting officer.

Q&A: Land-based gambling in the UK.

Gambling premises are restricted by regulations attached to gambling premises licences. The principal entrance to a casino must be from a public thoroughfare. No entrance may be taken from other premises used wholly or mainly by under 18s. Access to the premises must come from either the street or a betting premises licence. Music, dancing and entertainment cannot be provided or permitted on the gambling location. Alcohol cannot also be consumed on a gambling venue.

There are no exceptions for passive ownership. All owners with 10% or more of the equity or voting rights will be investigated. If a gambling business is owned by a publicly listed company or a company regulated by another regulated entity, the Commission may agree that it does not need to carry out further investigation of its beneficial owners.

Land-based operators must comply with the Licence Conditions and Codes of Practice attached to their operating licence. Licences must promote responsible gambling, provide training to staff on their responsibilities for preventing underage gambling and selling lottery tickets to children. They must also provide for self-exclusion for a minimum period of six months and up to at least five years, and participate in a national multi- operator self exclusion scheme. Online operators are required to participate. in the multi operator, self exclusions scheme, which allows players to self exclude from all participating land- based casinos.

Land-based gambling in the UK promotes socially responsible gambling. It also provides for self-exclusion for a minimum period of six months and up to at least five years. Online operators are required to participate in a multi- operator self exclusion scheme. It sets out the rules of gambling opportunities on offer and provides incentives and rewards. The company also makes an annual financial contribution to responsible betting organisations approved by the Commission.

The current applicable tax regimes for land-based gambling are as follows: Bingo. Bidding duty based on percentage of bingo promotion profits is 10%. Betting.

General betting duty is based on percentage of ‘net stake receipts’ for fixed odds bets, totalisator bets on horse or dog races and bets taken on betting exchanges. For financial spread bets it's 3%, for all other spread bets 10%. Pool betting duties are based upon percentage from bookmaker's profits from bets not on horses or dogs. Lottery duty based is on price paid or payable on taking a ticket or chance in a lottery is 12%.

For fixed odds bets, totalisator bets on horse or dog races and bets taken on betting exchanges, 15% of the profit is given for financial spread bets. For all other spread bets, 10%.

Machine games duty based on percentage of net takings from dutiable machine games. The applicable rate is for the highest rated game and applies to all takes from the machine.

There are three types of games in the UK. They are games with a maximum cost to play not more than £0.20 and a cash prize not less than $10. Games with the maximum prize to be won is £11 or more are worth 20%. Games costing more that £5 are also worth 25%.

Gambling at a casino in the United Kingdom is subject to a gaming duty. The duty is based on gross gambling yield for a six-month accounting period.