Why the explosion in gambling data is a boon for marketers

Commercial gambling accelerated amid the COVID-19 pandemic, and now more than ever it’s important to have a comprehensive look at gambling prevalence and behaviors in the U.S.

Online gambling showed strong growth amid the lockdown and now, with the vaccine effort fully underway, gamblers are returning to physical casinos as well. To better understand outlooks on commercial gambling, YouGov launched Global Gambling Profiles,* a tool that continually gathers data on gamblers. The dataset provides insights into where people typically gamble and the types of bets they tend to place, and uncovers how else they live their lives, from the sports and teams they follow to their core demographics their media consumption.

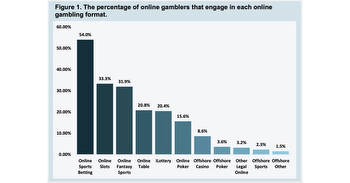

Popular types of gambling in the U.S.

Americans love the lottery. Although our sample of gamblers specifically excludes those whose only form of gambling is playing the lottery, the activity is still the most popular form of wager, even if its popularity is somewhat less pronounced among younger generations. Overall, almost two in five (37%) plan to play a lottery game in the next 30 days.

Casino betting appears next on the list, with about one in five Americans (21%) saying they will bet in a casino over the same period. This form of gambling is more or less consistent in its popularity among all age groups, except those ages 18 to 24, where it falls to 15%. Online forms of casino and card gambling are also popular, particularly with the 25-34 age bracket. Almost a quarter of this age group (23%) say they will play an online casino game in the next 30 days. That’s compared with a broader average of 15%.

One-sixth of our regular gamblers also show an inclination toward online slots (17%), while one in seven say they will buy a ticket for a lucky draw in the next 30 days (14%).

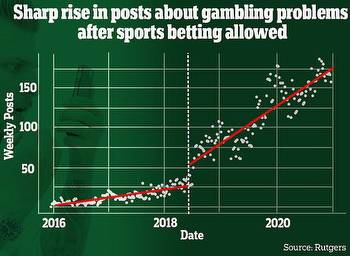

The intersection of sports and gambling stakes

It might come as a surprise to some that sports betting doesn’t feature in the top five, but that’s partially because of the fragmented nature of sports-based gambling, featuring various formats that we track separately.

Fantasy sports betting is the subcategory that comes closest to joining the top five. One in eight regular gamblers say they will play fantasy sports for money in the next 30 days (13%).

Gambling expenditures per month

Global Gambling Profiles also gives users actionable insights into the money placed on various types of gambling each month. Competition in the U.S. seems to be stiff across various categories in each price bracket, with slots tending to win out in some of the higher-stake brackets, but not by much.

The difference is most noticeable in the $100-$500 spend range. One in seven gamblers (14%) say they place between $100 and $500 on slots on average per month, leaving behind the other categories: casino games (11%), sports and fantasy sports betting (11%) and bingo (10%). Each of the categories draws bets in the $501–$2,000 range monthly, from 6% to 7% of U.S. gamblers.

As the gambling market continues to diversify and evolve post-pandemic, it’s more important than ever to track and measure consumer attitudes toward gambling. YouGov’s Global Gambling Profiles can help brands delve deeper into how people place bets and connect these behaviors with how bettors view general legislative change, sport sponsorships and other key industry developments.

* Methodology

Regular gamblers in this piece are defined as those who have engaged in any form of gambling other than the lottery in the past 30 days. YouGov Global Gambling Profiles, which includes data from 23 markets, is based on continuously collected data from several sources rather than from a single limited questionnaire. Data referenced is based on a sample size of between 1,337 and 1,791 U.S. adults. Online interviews were conducted in April 2021.