Penn National Gaming: The Real Value Is In Its Casinos (NASDAQ:PENN)

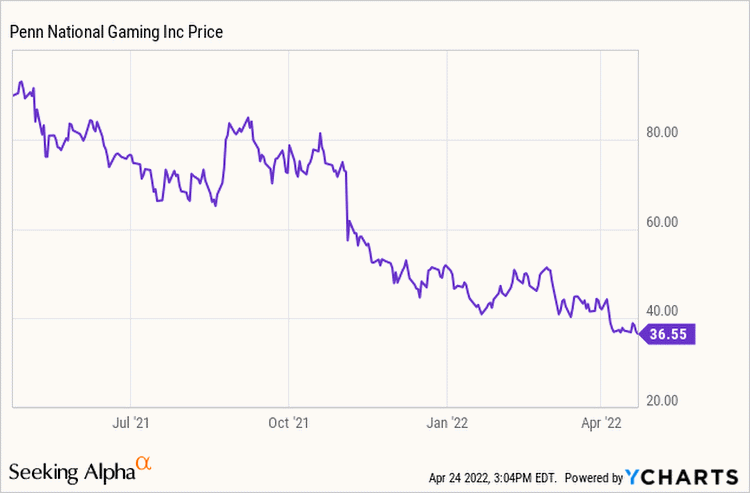

Penn's stock price has declined from $46.97 on January 9th to $36.55 today. The decline is due to general jitters, inflation, Fed nerves, the Ukraine war, gas prices and the perception that pandemic stimulus checks inflated gaming at most of the nation's regional casinos. Stimulus checks going to the older demographics did not boost revenue for casinos in general. The market is bearish on consumer discretionary stocks. However, where Penn is concerned, much of dip has come out of profit taking. In 2021, Penn's share price reached $115. It's possible that the stock will reach $100 in early 2021.

Penn's stock has been on a rocket ride since it bought Barstool Sports in early 2020. The company's brick and mortar casino properties are secure. Management's statements about the future of casino gaming were overblown. Online gaming is the real future for the sector. Penn's deal made sense because it acquired a massive data base relatively cheap. The market share of BarStool is estimated to be 6% of a $25 billion market by 2025. That would put its Bar stool vertical to around $1.5 billion in sales. This is a very possible $7 billion for Penn.