Fontainebleau Las Vegas opens Wednesday. Here’s what it means

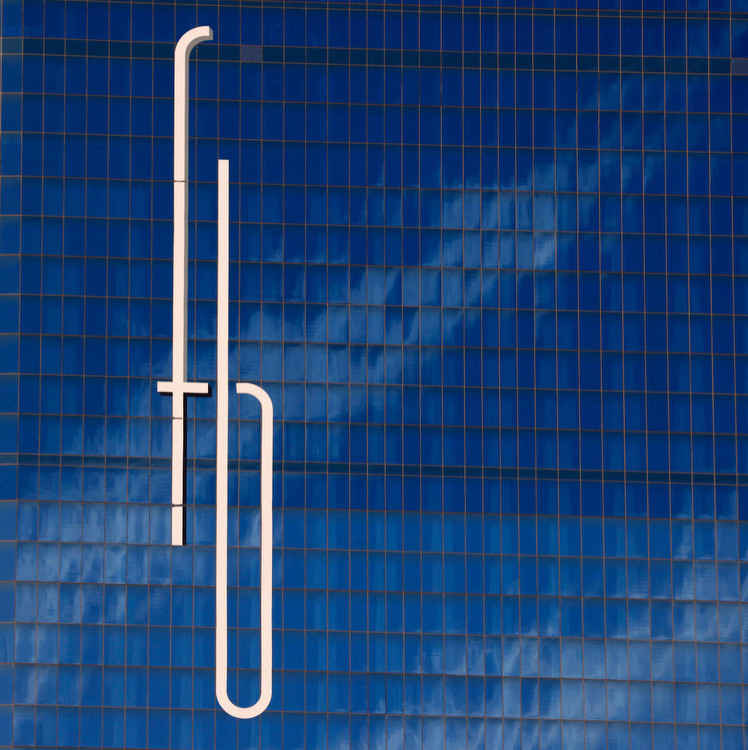

If you look hard enough, you can find bow ties in the most unusual places at the Fontainebleau.

The new resort-casino’s logo is on the carpets, in the shape of the wayfinding signs and repeating patterns in chandeliers, on drawer handles in rooms, on trash cans and in the shapes of sofas and banquet hall chairs.

The bow ties are an homage to Fontainebleau Miami Beach’s original architect, Morris Lapidus, who wore them daily, but they’re also more than that. They’re a visible — and frequent — example of the attention to detail that runs through the whole project, Fontainebleau Las Vegas President Mark Tricano said.

“Our target customers are the people that appreciate the extra step and the details because they know those take time, they take work and resources, they take thought,” Tricano told the Las Vegas Review-Journal on a tour before opening. “We want to appeal to those that appreciate those finer details.”

Fontainebleau opens late Wednesday as a $3.7 billion project that’s 18 years in the making. The 67-story, 3,644-room property was first conceptualized by Fontainebleau Development CEO Jeffrey Soffer, who had bought the historic Miami sister property the same year.

The building was roughly 75 percent complete when the economy crashed in 2009. Bankruptcy, changing ownership and multiple new visions came and went in the following years before Soffer’s team once again acquired the still-empty, nearly done building in 2021 with partners in Koch Real Estate Investments.

Now there are thousands of workers on-site daily, putting the final touches on rooms, training in restaurants and planning a star-studded opening night party.

What to expect

Though the resort is the tallest occupiable building in Nevada, executives said they worked hard to make the space feel intimate and navigable. The casino at the property’s center has 1,300 slots and 128 table games with 42-foot ceilings. Guests in retail or at the food hall on the second floor can look down into the casino.

The property has 36 food and beverage outlets, and the new-to-market names like Mother Wolf and Papi Steak are part of the strategy to draw East Coast and Southern California customers who are familiar with the hot eateries elsewhere.

Still, Tricano said he doesn’t view the property as a foodie-first resort. He points to the 550,000 square feet of convention and meeting space and the 55,000-square-foot Lapis Spa as examples of what will draw customers.

“I do view this as a wholly integrated resort where it’s going to find that balance between all of those elements of the business,” Tricano said. “In order for us to be successful long term, that’s what we have to do as a team. If we allow any one of those elements to dominate, I think we would be shortchanging ourselves in some of those other areas.”

The resort often leans into connections to the Miami Beach spot. For instance, the lobby bar is named Collins, after the famed avenue and several eateries are replicated in Vegas. Like Miami, art plays a prominent role in decorating the property — including a 48-foot-tall sculpture in the south lobby, where drive-in and convention guests are most likely to enter.

Years in the making

All the glitz and glamour took years to achieve.

Billionaire corporate raider Carl Icahn purchased the incomplete building for $150 million in February 2010 and held onto it through the worst of the recession. In 2017, it sold to real estate investment firms Witkoff and New Valley for $600 million. The new project targeted a 2022 opening. But construction stopped during the pandemic-related lockdowns and funding once again dried up.

By Febraury 2021, Soffer and his team got the keys back once again.

Michael Parks, an executive vice president with commercial real estate firm CBRE Group Inc., listed the hotel for Icahn’s company when it was back on the market in late 2015. He said Icahn put significant capital in maintaining the structure’s condition. A full-time staff was there to keep the plumbing going and turn on the A/C units in the summer so the wallpaper wouldn’t curl, among other upkeep.

“There were always rumors that the property was going to be demolished and sold off or scrapped, that it was worth more by doing that,” Parks said. “But the Icahn organization did a great job of maintaining the facilities so that years later, someone could come in and actually finish the property off.”

Still, finding a buyer who was willing to take over a nearly complete project was not without its challenges. Park said buyers had to be willing to follow early plans instead of creating their own since so much was complete.

Richard “Boz” Bosworth, a hospitality executive who previously led Virgin Las Vegas, said his team was among one of the interested buyers in 2016. They ultimately walked away and purchased the former Hard Rock Hotel.

“I think when you have a ‘broken construction’ project, it’s not for the faint of heart to go in,” he said, noting that though the original developers invested more than a billion dollars, estimates at the time suggested it would take another multibillion-dollar investment to open.

Boost for the north Strip

“Unfortunately, we couldn’t come to terms with the seller and change directions,” Bosworth said. “But I do believe that this has the bones and the makings of what will be one of the most relevant convention center, geographically located hotels in the world, certainly the U.S.”

The short distance between Fontainebleau and the Las Vegas Convention Center West Hall is expected to play a large role for the property. Group sales teams are pushing the synergistic opportunities between the two sites, while food and beverage outlets expect to get foot traffic from the conventioneers.

Expect the megaresort competition to heat up with Fontainebleau’s opening.

Bosworth said he expects “a bit of a battle” with Resorts World, the most recent addition to the Strip that opened in June 2021.

“Resorts World, with its proximity to the convention center, has been able to grab the lion’s share of that business,” he said. “But now with Fontainebleau, that is perhaps a more dramatic property.”

Still, observers hope the competition will bring a boost to the north Strip.

Steve Siegel, CEO of The Siegel Group, said he’s watched the project develop, then sit idle, then develop once again from his nearby home.

“Any time a building is closed, it’s not the greatest for the neighborhood or the community,” Siegel said. “I think just the revival of it, when the lights turned on — it changed the whole area. Now it starts creating more critical mass with Resorts World, the convention center expansion and Fontainebleau there.”

His development group is in the early planning stages of a large-scale, mixed-use development for land it owns just south of the hotel and next to its bagel shop, Siegel’s Bagelmania. Siegel Group’s Chief Business Officer Michael Crandall said foot traffic has greatly increased since the West Hall opened in 2021 and he’s expecting more growth.

“I cannot wait for everyone to see and experience, obviously today, but in five to 10 years from now what the north Strip is going to become,” Crandall said. “It’s going to be game-changing for Vegas.”

McKenna Ross is a corps member with Report for America, a national service program that places journalists into local newsrooms. Contact her at mross@reviewjournal.com. Follow @mckenna_ross_ on X.