Evolving trends in UK gambling: The rise of online slots and regulatory responses

The UK gambling landscape is witnessing dynamic shifts, as evidenced by the latest datasets released by the UK Gambling Commission (UKGC) tracking gambling participation up to December 2023.

Since March 2020, the Commission has been diligently gathering data from major UK operators providing online betting solutions and casino online games, covering 80% of the online gambling market, as part of its initiative to monitor gambling behaviors during the COVID-19 pandemic.

This release offers a comprehensive comparison between Quarter 3 (Q3) of the financial years 2022 to 2023 and Q3 of 2023 to 2024, providing insights into how the market has evolved over the course of a year.

Stakeholders are cautioned against making direct comparisons on industry statistics, as data may include free bets and bonuses and may not encompass all operators.

Notably, the data for Q4 2023 reveals a significant 4% increase in Gross Gambling Yield (GGY) for online gambling, reaching £1.3 billion compared to £1.24 billion in Q4 2022. This growth is attributed to heightened activity in slots and real event betting.

The sports betting datasets highlight a remarkable doubling in GGY activity registered by real-event betting during December 2023, with the month generating a real event betting GGY of £196 million and involving 5.7 million participating accounts.

Of particular significance are the datasets for online casinos, which revealed a peak Q3 GGY on slots of £618 million, marking a notable 6% increase and deemed as “the highest recorded GGY slots quarter” since data collection began in March 2020.

Regarding participation, Q3 2023 data indicates that the slots vertical reached a peak of 4,206,392 accounts during December, reflecting a consistent increase compared to previous months. Figures cited show an increase from the same period in 2022, with the highest number of active accounts visible in December.

In terms of retail performance, the GGY of Licensed Betting Offices (LBOs) rose slightly by 0.5% to £563 million during Q3.

However, datasets noted a 4% decline in the total bets placed on retail services, amounting to £3.3 billion. Retail data further showed a 10% decline in wagering on Self-Service Betting Terminals (SSBTs) and a 3% decline on LBO machines.

In reference to safer gambling metrics, online gambling data highlighted a 3% increase in the number of slots sessions exceeding one hour.

However, there was a decrease in the average session length to 17 minutes and a 2% reduction in total customer interactions.

In conclusion, the Commission is actively investigating the categorization of certain products, which may lead to changes in data between verticals, though this is not anticipated to impact the overall totals.

Stakeholders are reminded to interpret data with caution, considering potential double-counting in quarter comparisons due to participation across multiple verticals.

Surge in Revenue:

Figures from the UKGC reveal a staggering surge in revenues within the betting and gaming industry, amounting to £15.1 billion in the fiscal year leading up to March 2023, excluding proceeds from the National Lottery. This remarkable rebound follows a £1.5 billion setback during the peak of the pandemic, attributable to the closure of betting shops and the cancellation of sporting events.

Boom in Online Casino Sector:

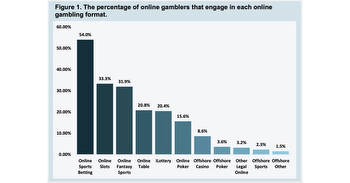

Online casino products, particularly slot machines, have emerged as dominant revenue drivers, surpassing previous records. Losses stemming from digital slot games have more than doubled since 2016, reaching an unprecedented £3.2 billion. This substantial figure now accounts for nearly 30% of all non-Lottery income, underscoring the undeniable allure of online slots among punters.

Concerns and Regulatory Responses:

Mounting concerns surrounding problem gambling and excessive losses have prompted the government to consider regulatory interventions, particularly in the realm of online slot machines. The proposed consultation seeks to address the addictive nature of these games, with stakeholders advocating for stricter regulations reminiscent of those imposed on fixed-odds betting terminals (FOBTs) in 2019.

Insights from Experts:

Dr. Matt Gaskell, overseeing the NHS Northern Gambling Service, offers valuable insights into the detrimental impact of slot machines, designed to prolong play and exploit decision-making processes. He welcomes regulatory initiatives aimed at lowering stake limits, emphasizing the urgent need for robust measures to mitigate gambling-related harm.

Continued Support for Problem Gamblers:

As discussions on regulatory measures unfold, it is imperative to ensure continued support for individuals grappling with problem gambling. Resources such as the NHS National Problem Gambling Clinic and GamCare play a pivotal role in offering assistance and guidance to those in need, advocating for a holistic approach to addressing gambling-related harm.

Conclusion:

The evolving landscape of gambling in the United Kingdom paints a complex picture, characterized by the meteoric rise of online slot machines and the ensuing debates over regulatory interventions. While record-breaking revenues reflect the industry’s resilience, it is imperative to prioritize the well-being of consumers and address the risks associated with problem gambling. Collaborative efforts between regulators, industry stakeholders, and support organizations are paramount in fostering responsible gambling practices and safeguarding individuals from harm.