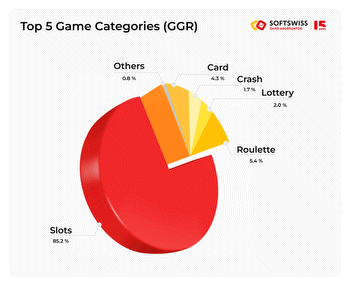

Are slots losing popularity?

What are the most popular games? What iGaming providers have achieved the greatest success? SOFTSWISS, an innovative company providing a complete ecosystem of comprehensive software solutions, shares valuable insights across regional markets.

The analysis presented is based on the Game Aggregator data spanning the second half of 2022 and the first half of 2023.

Europe

Slot games remain popular in Europe, even though they lost around five p.p. during H2 2022 and H1 2023. Despite this decline, their market share still exceeds 80% among the other gaming categories. In contrast, card games improved their position by almost four p.p.

The top five most popular game categories underwent minor changes in Q2 2023. The Total Bets Sum in Craps games saw a substantial increase, growing 2.7 times in comparison to the previous quarter. This boost in performance secured the fifth position for this type of games in the top rankings, displacing casual games.

Gates of Olympys, Big Bamboo and Midas Golden Touch emerged as some of the most popular games during the past year. Notably, the landscape of top games exhibited significant variations from quarter to quarter.

In the European gaming sector of 2022-2023, top-performing game providers include Amatic, Amusnet (EGT), BGaming, Evolution, Pragmatic Play, Push Gaming, and Relax Gaming. Their positions in the rankings experienced subtle shifts from quarter to quarter.

Asia

The top five most popular game categories in Asia have exhibited a consistent trend since the final quarter of 2022. Slot games hold a prominent position in the asian gaming landscape, with their market share exceeding 80% compared to other categories.

Gates of Olympys claimed the title of the most popular game in Asia in Q4 2022, and has maintained its leading position since. Meanwhile, another popular game, Bonanza Billion, has experienced fluctuations in its rankings within the top five since the end of the previous year. The Total Bets Sums of Aviator increased twofold during the first half of this year, propelling the game into a leadership position. In contrast, the once-popular game, Hot Fruits, lost its foothold in the top rankings during the second quarter of 2023.

As for the most successful game providers in Asia, it should be noted that Evolution, Pragmatic Play and BGaming have continually jostled for positions within the top five over the past four quarters under review. Play’n Go and Amatic ceded their places in the rankings to 1spin4win and Amusnet (EGT), with the latter heading the list in Q2 2023.

Tatyana Kaminskaya, Head of SOFTSWISS Game Aggregator, comments: “The popularity of the Aviator game can be explained by simple interface and fast payouts. What sets it apart even further is its distinctive gameplay mechanics, which significantly differ from other crush games in the market. Notably, Aviator provides players with the illusion of “control” over the game, adding an extra level of excitement and intrigue.”

Latin America

The top five of the most popular game categories in LatAm have remained consistent over the last year, with almost 60% of these categories dominated by slots.

The current top five most popular games are as follows:

Roleta Brasileiri – 8.27%

Aviator – 5.97%

Gates of Olympus – 5.24%

Sweet Bonanza – 3.44%

Crazy Time – 3.14%

Notably, Aviator surged to the top in Q4 2022, experiencing a significant increase in the Total Bets Sum, nearly 170 mln euro more in comparison with the previous quarter. This success propelled its provider, Spribe, from the tenth place in Q3 2022 to the fourth in Q2 2023, displacing Play’n GO from the top five. Other providers, specifically Pragmatic Play, Evolution, Playtech, and BGaming, remained in the top with minor shifts in their rankings over the past year.

The top five most popular games account for approximately 25% of the Total Bets Sum across all games in Latin America, while in Europe and Asia the same covers around 10%. Another noteworthy market trend is the displacement of slots with roulette, and the growing preference for live games.

Carla Dualid, Regional Business Development Manager at SOFTSWISS in LatAm, comments: “Players in Latin America in the context of online gambling may differ from players in Europe in several ways. Most Latin American players bet through mobile devices and prefer online play. Local casino slot players tend to place small but regular bets, which distinguishes them from European online casino players, who, in turn, bet less frequently, but wager larger sums on slots. Speaking about the LatAm market, we should keep in mind that Brazil is the most active player in it. Such factors as economic potential, increasing Internet penetration, mobile accessibility, and regulatory changes are making the Brazilian market more attractive for operators.”

About SOFTSWISS

SOFTSWISS is an international iGaming company supplying certified software solutions for managing gambling operations. The expert team, which counts 1,400 employees, is based in Malta, Poland, Georgia, and Belarus. SOFTSWISS holds a number of gaming licences and provides one-stop-shop iGaming software solutions. The company has a vast product portfolio, including the Online Casino Platform, the Game Aggregator with thousands of casino games, the Affilka affiliate platform, the Sportsbook Platform and the Jackpot Aggregator. In 2013, SOFTSWISS was the first in the world to introduce a Bitcoin-optimised online casino solution.