What Maryland Does With Its Taxes on Gambling

Maryland's gambling revenue is taxed on July 15. Sports betting taxes are linked to education funding. For casinos and lottery, the revenue goes to a diverse set of programs and accounts.

Sportsbooks in Maryland contribute 15% of their revenue to Blueprint for Maryland’s Future Fund. The fund is dedicated to early childhood education and public schools. It has added $1.8 million since sports wagering became legal in December 2021.

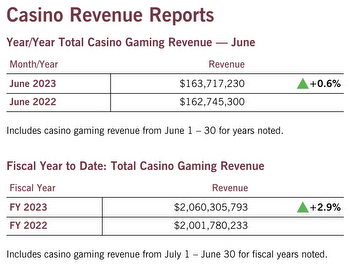

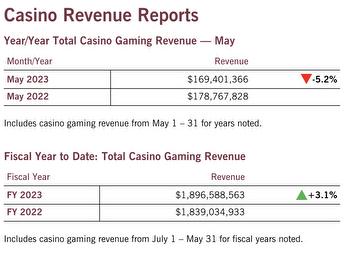

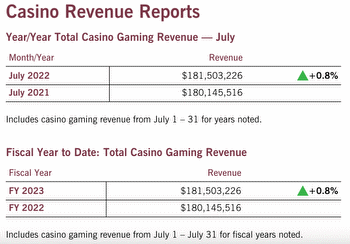

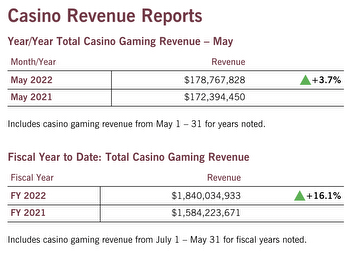

Maryland casinos pay different tax rates based on the type of game. Most of the money goes to the Education Trust Fund, followed by Local Aid and the state's horse racing industry. The Video Lottery Terminal Fund allocates half of its revenue to businesses near the six casinos. The other half goes for all qualifying businesses throughout the State. In 2021, casinos made $1.75 billion in revenue.

Maryland spends its gambling taxes on education, local aid, horse racing funds and responsible gaming.

Profits from the Maryland Lottery go to the state's general fund. Casino revenue contributed $723.5 million in 2021. Lotteries tickets contributed about $667.4 million.