Las Vegas Sands Eyes Casino For NY's Long Island

Move over Macau and Singapore. Las Vegas Sands is betting on Long Island, unlike other city-centric developers spending millions to win a casino license in New York. All these new proposals are focusing on corporate meeting spaces and tourism boosts to the economy to turn the odds in their favor.

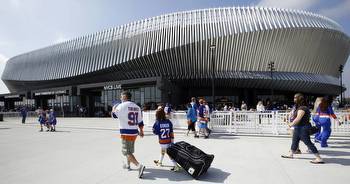

Las Vegas Sands is pursuing a multi-billion flagship casino, entertainment and hospitality development following its agreement to purchase a long-term lease over the home to the Nassau Veterans Memorial Coliseum, opened in 1972 on Long Island in New York. This would be the company’s first entertainment project in the U.S. since it sold its Las Vegas properties last year.

Pending approvals from the Nassau County legislature, Sands will acquire control of up to 80 acres in Nassau County. Pre-pandemic, Long Island saw more than 9 million visitors annually, according to Nassau County Executive Laura Curran.

High-quality casino gaming is planned to represent less than 10 percent of the development’s total footprint. Proposed plans for the Nassau Coliseum include four and five-star hotels, celebrity chef restaurants, and a world-class performance venue in honor of the Nassau Coliseum’s live music legacy.

As opposed to some of its competitors, Sands’ ambitions look to bring tourists and meeting professionals outside of the obvious choice of Manhattan, some 30 miles to the east on Long Island. New York City is still struggling to return its tourism and meetings business to pre-pandemic levels, pulling out the stops with new marketing campaigns. But Sands is confident in its ability to make Nassau County a sought-after destination.

Las Vegas Sands is a developer and operator of world-class integrated resorts, which refers to casinos that integrate some combination of accommodations, entertainment, retail, fine dining and convention facilities. Despite being U.S.-based, Sands has no exposure to the domestic market after selling its stakes in Vegas when Apollo Management purchased The Venetian Resort for $6.25 billion in early 2022. Its current portfolio consists entirely of casino hotels in Asia, with five in Macau and Marina Bay Sands (MBS) in Singapore.

Rob Goldstein, CEO and chairman of Sands, believes that the Sands proposal can drive outsized tourism into Nassau and transform the county.

“Our bid is very much traditional on the thinking of LVS large-scale with numerous non-gaming assets, lots of meeting space, probably 400,000 square per foot new space,” said Goldstein on the company’s fourth-quarter earnings call recently.

Sands stands out from other hopeful casino developers focusing their sites on New York City itself for potential entertainment developments. Several of these are also pivoting poker tables to the back of their proposals to highlight economic benefits from tourism and community impact.

Related Companies, the developer behind Hudson Yards in midtown Manhattan, was first to team up with Wynn Resorts to propose transforming the undeveloped train yard next to the Jacob Javits Convention Center. Promises for the site bounced around hotel rooms, nightclubs and restaurants, with ideas for a school, affordable housing and parks also added to the mix.

Similar to the Sands bid, “the gaming will be less than 10 percent of the resort,” said Jon Weinstein, a spokesman for Related Companies, in an interview with the New York Times.

Caesars Entertainment is partnering with SL Green Realty Corp. and Roc Nation–full-service entertainment agency founded by Jay Z to pursue a bid for transforming Times Square. The ambitious collaboration highlights the development’s potential to not only accelerate economic recovery for Broadway, restaurants and hotels, but also improve security and congestion through an embedded traffic plan.

Billionaires Stefan Soloviev and Steve Cohen also joined the competition, with Soloviev hoping to add a Ferris wheel to the Manhattan skyline and Cohen to develop Citi Field in Queens. Various partnerships continue to form and target other New York City boroughs as well.

Sands’ proposal, along with other bidders, is contingent on winning one of the recently announced downstate New York gaming licenses. At the beginning of 2023, the New York Gaming Facilities Board issued a Request for Application (RFA) for up to three commercial casinos in the state.

There are four existing destination resort casinos in upstate New York, including Resorts World in Queens and MGM’s Empire City Casino in Yonkers. While all three licenses are said to be competitive by the board, these two venues are established entities known to state policymakers and are widely speculated to receive two of the three licenses.

Currently, both locations operate as a so-called racino, which does not have live table games or human dealers, but solely horse race tracks and digital betting. Properties that have slot machines only are said to be generating $2 billion in revenues on an annual basis.

Applicants will be evaluated on four objectives, with 70 percent of consideration focused on the plan’s economic activity and business development factors, and the rest equally distributed between tourism impact, workforce enhancement and diversity factors.

The board is accepting initial questions from prospective bidders until February 3, and expects to host a second round in the future. While no deadlines are set for bids at the moment, a nonrefundable $1 million application fee is required for bidders to be considered, and a minimum capital investment and license fee of $500 million is required for a bid to qualify.

Goldstein added in the earnings call that New York is an extraordinary and unique opportunity, and the LVS bid is positioned to grow tourism with a transformative product. The former state governor, David A. Paterson, is a senior vice president at the company.

“We’ve been trying to do New York for a number of years,” said Goldstein, “but it looks like this is finally someone’s opportunity. Hopefully, it’s ours.”