Korean Gaming Giant Netmarble Buys Hong Kong Casino App To Further Global Expansion

Netmarble has agreed to buy Hong Kong-based social casino game company SpinX Games for $2.19 billion in a deal that will expand the South Korean gaming giant’s business outside its home market amid a surge in gaming during the pandemic.

The Seoul-based company says the deal will let the company “continue its global expansion by adding a new genre of games to the current extensive roster.”

“Netmarble is already a very large company,” says Sean Su, an independent technology consultant in Taiwan. “The reason I think they would buy SpinX is gambling in Asia is a huge market, not just Hong Kong. It makes sense they would buy SpinX because it’s a great revenue maker.”

Founded in 2014, SpinX’s games include Cash Frenzy, Lotsa Slots and Jackpot World. "The social casino genre shows continued global growth, and we are very excited to execute a share purchase agreement with SpinX Games, one of the leading companies in the genre,” Netmarble CEO Lee Seung-won says in the statement.

SpinX is growing quickly, notes Chris Marshall, associate vice president for IDC Asia Pacific. Netmarble bought the company as a way to expand beyond the competitive Korean home market, Marshall adds. “NetMarble faces stiff competition in South Korea, a country that dominates the mobile gaming industry in the Asia Pacific region,” he says.

“We believe NetMarble needs to strengthen its global presence and diversify its capabilities to stay competitive,” says Marshall. “The acquisition of SpinX is one way of doing this,” he says. “This acquisition allows Netmarble to not only widen its offerings into different genres, but also allows them to expand their global reach.”

Analysts expect more gaming sector tie-ups as the world’s top brands try to capture an internationalized market that is growing because of pandemic-era play. In a recent case, China-based Tencent said it would buy the British video game developer Sumo. Social game developer Zynga and digital entertainment firm Electronic Arts have also announced deals to acquire other firms.

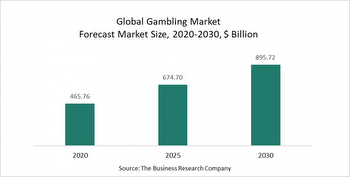

According to market research firm Strategy Analytics, the global gaming market is expected to grow to $250 billion by 2025 from $150 billion last year. Monthly active mobile game users in Asia should increase at a 4.9% compound annual growth rate this year through 2025, IDC forecasts.

“The boom in the gaming industry has led increased M&A,” Marshall says, anticipating more high-value mergers, acquisitions and initial public offerings over the next four years.