Half-billion dollar Ponzi scheme funded Las Vegas lawyer's 'lavish lifestyle,' gambling debts, feds claim

LAS VEGAS (KLAS) — More than 600 investors took part in a Las Vegas-based Ponzi scheme involving nearly half-a-billion dollars that perpetrators used to buy luxury items and pay off gambling debts, court documents revealed.

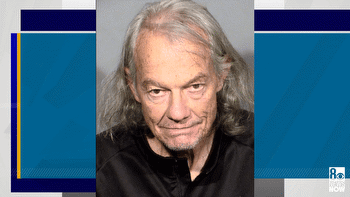

Matthew Beasley, 49, faces federal charges in connection with an FBI agent-involved shooting on Mar. 3 at his home near the 215 Beltway and Ann Road. Beasley is charged with one count of assault on a federal officer for pointing a gun at an FBI agent when they came to his house to talk to him about their investigation, officials said.

The federal lawsuit filed Tuesday by the Securities and Exchange Commission against Beasley, his law firm, several employees and promoters alleges investors were told they could “purchase interests in insurance tort settlements” and that they would receive at least 12.5% return every 90 days, court documents said.

The total amount of investor money that flowed through Beasley’s law firm bank account was at least $449 million, documents said. The amount paid out was unknown as of the filing of the lawsuit.

Lawyers with the SEC allege Beasley and the others named in the lawsuit “used the bulk of investor money to fund lavish lifestyles, including purchasing luxury homes and properties, a private jet, ATVs, boats, and numerous luxury cars for themselves and their relatives,” court documents said.

Beasley also reportedly told the FBI he transferred $4 million to his “bookie” to pay off gambling debts, the lawsuit said.

According to the lawsuit, during the standoff with the FBI in March, Beasley “repeatedly confessed to an FBI negotiator that … [the] investment scheme was actually a Ponzi scheme that started in 2016 or 2017.”

The lawsuit filed Tuesday also names Jeffrey Judd, 50, of Henderson; Christopher Humphries, 48, of Henderson; Shane Jager, 47, of Henderson; Jason Jongeward, 50, of Utah; Roland Tanner, 65, of Henderson; and Denny Seybert, 44, of Henderson.

“Beginning at least as of January 1, 2017 and continuing until March 2022, the J&J Entities, directly and through Judd, Humphries, Jager, Jongeward, Seybert, and Tanner, offered investments in purported personal injury settlement contracts,” SEC lawyers claim in court documents. “Judd told investors that he had a litigation financing business with his attorney, Matthew Beasley, whereby Judd invested money in contracts with personal injury plaintiffs while Beasley procured those contracts through his contacts with other attorneys around the country. Judd told investors that Beasley and his law firm Beasley Law Group had relationships with personal injury attorneys whose clients had settlements with insurance companies, and who were willing to pay a premium to receive a portion of their settlement in advance rather than wait for payment from the insurance companies.

According to the lawsuit, investors made purchase agreements in installments of $80,000 or $100,000.

“Judd told different investors that they would receive different returns. Judd told some investors that they would make up to $22,000 within 90 days on an investment of $100,000. Judd told other investors they would receive 12.5% on their investments (50% on an annual basis), for a return of $12,500 within 90 days on an investment of $100,000 or $10,000 within 90 days on an investment of $80,000,” the lawsuit claims.

Last month, a man filed a civil lawsuit against Beasley and others for the alleged Ponzi scheme.

In the suit, the man claims that between 2017 and 2022 Beasley and Judd convinced him to invest millions of dollars in short-term investments, written into contracts, that would pay a return of 7.5-13% in 90 days.