Gambling Industry Worth $525 billion by 2023

As the gambling industry continues to experience exponential growth due to several factors such as growing interest, high adoption, increasing per capita income, and the rising number of dual-income households, forecasters are looking at theatrical growth by the year 2023. The growth rate is estimated to be even more significant following a turbulent year at the hand of COVID-19. Google Trends indicates that the highest frequency of searches in the last five years for 'Online Casinos' was in July 2020. The need for entertainment fueled by lockdowns will undoubtedly have far-reaching effects on the growth forecasts.

Global Gambling Industry Forecast

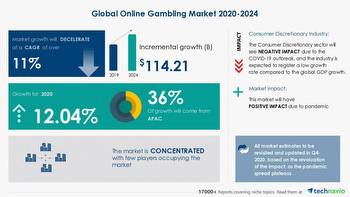

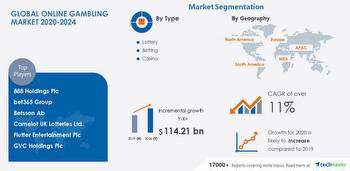

An ambitious global outlook and forecast set the gambling industry's estimated market revenue at$525 billion by 2023. The forecast was released in September 2018 by ResearchAndMarkets.com, the world's largest market research store. The comprehensive report detailed that the key factors that elucidated the projected growth, including dynamics and segmentation. In all likelihood, the forecast may fall short after the gambling industry, particularly online gambling, experienced an influx of new registrations in 2020, mainly attributed to COVID-19.

In 2018 the global gambling market size reached a value of nearly $449.3 billion, with an estimated market size close to $490 billion reported in 2019. The market grew at a compound annual growth rate (CAGR) of 4.1% since 2014. ResearchAndMarkets.com forecast that CAGR will continue to grow at approximately 4%, although CAGR may be significantly higher following the events of 2020.

A forecast released in September 2020 by Statista predicted a global online gambling market value of more than $93 billion in 2023. A 2020 forecast by ResearachAndMarkets.com revealed that the online gambling market's size was close to $59 billion in 2019, with an anticipated growth rate of 13.2% in 2020 to reach $66.7 billion. The forecast correlated with Statista, predicting that the online gambling market value will reach $92.9 billion in 2023, at a CAGR of 11.64%.

USA

Increasing penetration of online gambling across North American has led to the latest forecast indicating that the North American gambling industry could reach upwards of US$110 billion before the end of 2020. North America has complex gambling regulatory processes, but the legalization of sports betting in 2018 allowed online gambling companies to get a foothold in the sports betting industry that's reported global revenues of $85 billion in 2019.

Europe

The gambling industries in Italy, Spain, and the UK have enjoyed popularity for several years, with the UK leading Europe in delivering the most developed regulatory framework.

The UK reported £14.3 billion in gross revenue from October 2018 to September 2019, with online gambling accounting for £5.6 billion, followed by sports betting with £3.0 billion.

Spain's gambling industry generated more than €9 billion in 2019, with online gambling generated €747 million in revenues in 2019. The gambling industry employs an estimated 250,000 people, while the government claims 45% of the annual gambling revenue.

Gambling, betting, and lotteries are legal in Italy. The gambling industry reported €110 billion in revenue for 2019, with the highest amount of money spent on casino games, poker cash, and poker tournaments. The Italian government claimed considerably less tax than Spain, with only €11.4bn reserved for tax.

Asia

China, Hong Kong, South Korea, and Japan are the largest revenue generators in the Asia-Pacific (APAC) region, with governments in APAC relaxing gambling regulations to generate revenue. The liberalization of regulatory frameworks encourages gambling market growth with the taxes generated from taxes funding social welfare activities. Gambling revenues are vital to several APAC economies accounting for a large part of the country's GDP.

New Markets

Latin America

Several LATAM countries have come to the fore to reap the benefits of promoting a gambling industry. Argentina's total gambling market is worth $2.4 billion, with the government encouraging the introduction of online sportsbooks to recouple losses caused by COVID-19. The government now recommends a tax increase from 2% to 5% on the iGaming segment to overcome economic deficits worsened by the pandemic.

Similarly, Chile has put legislation in place to allow physical casinos to launch online casinos in the wake of COVID-19.

Brazil has put forward talks to introduce online sportsbooks to generate additional tax revenue from its 200 million-strong population that displays deep sports fandom.

Africa

South Africa has a thriving casino industry, but online sportsbooks are certainly making a more significant impact. Legislation to allow online casinos to operate in the country have been delayed and seem unlikely to be brought to fruition in the imminent future. The majority of African countries have experienced growth in the sports betting industry, with online sportsbooks proliferating.

Forecasts indicate that global gambling industries anticipate dramatic growth, with legislation put into place, enabling governments to generate tax revenue, boost GDP, job creation, and fund social welfare. Various regions still hesitate to embrace the benefits that a gambling industry holds, but many have encouraged the gambling industry and envision a continuation of market growth.